These are the best performing Nigerian stocks of 2025. While past performance is not indicative of future results, these equities are worth keeping an eye on in 2026.

A Historic Year for Nigerian Equities

2025 was nothing short of extraordinary for Nigerian equities. The Nigerian Exchange (NGX) closed the year with a stunning 51.19% return, marking the best full-year performance since 2007 when the market gained 74.74%. To put this in perspective, only four years in recent history have delivered returns above 45%: 2020 (50.03%), 2013 (47.19%), 2023 (45.90%), and 2017 (42.30%).

The market’s total capitalization surged by ₦36.62 trillion to reach ₦99.4 trillion, up from N62.76 trillion in 2024. This wasn’t a flash-in-the-pan rally driven by a handful of stocks, that is, over 45 listed companies posted gains exceeding 100%, with some delivering returns above 1,000%. The NGX All-Share Index closed at an unprecedented 155,613.03 points, the highest in the Exchange’s history.

What made 2025 different was the breadth of the rally. Consumer goods stocks surged 129.57%, insurance stocks climbed 65.64%, and industrial goods rose 58.91%. Even the banking sector, despite mid-year headwinds from CBN directives, managed a respectable 39.77% gain.

What Experts Are Saying About 2026

Market analysts remain cautiously optimistic heading into 2026. Lizzie Kings-Wali, CEO of 4Stone Capital Limited, points out that Nigerian equities remain remarkably undervalued compared to peer markets. The NGX All-Share Index trades at just 8x price-to-earnings ratio, compared to 16.5x for MSCI Emerging Markets and 12.1x for Frontier Markets.

“I remain cautiously optimistic on Nigerian equities, given its discounted valuation,” Kings-Wali noted. She expects that as inflationary pressure eases and consumer purchasing power improves, fast-moving consumer goods stocks should see upward rerating in 2026.

The prognosis for lower interest rates also creates an interesting dynamic. While fixed income securities currently offer attractive yields around 20%, the expectation of a lower yield environment in 2026 could drive more capital toward equities as investors seek higher returns.

The Stocks That Delivered Massive Returns

1. NCR Nigeria Plc: +1,354%

Leading the pack with an astronomical 1,354% gain, NCR Nigeria’s share price rocketed from ₦5.00 to ₦72.70. The company’s transformation was driven by growth in its World Customer Services segment, with nine-month revenue climbing 13.9% year-over-year. Despite its relatively small market capitalization of N7.85 billion and just 108 million shares outstanding, NCR demonstrated that focused operational execution can deliver outsized returns.

2. Eunisell Interlinked Plc: +497%

This industrial player surprised many investors with a 497% gain, closing at ₦115. The company’s performance reflected strong demand in its core business segments and improving operational efficiency.

3. Beta Glass Plc: +470%

The industrial goods manufacturer delivered a 470% return, making it the top performer in its sector. Beta Glass benefited from renewed construction activity and improving demand dynamics in the packaging industry.

4. Guinness Nigeria Plc: +398%

The brewing giant’s near-400% rally was supported by declining FX losses and improving profitability. As consumer confidence recovered and foreign exchange pressures eased, Guinness emerged as one of the strongest performers in the consumer goods sector.

5. MeCure Industries Plc: +369%

Leading the pharmaceutical sector, MeCure’s share price surged from ₦13.90 to ₦55, lifting its market cap to N220 billion. The company now ranks among the 40 most valuable companies on the NGX, reflecting investor confidence in Nigeria’s growing healthcare sector.

6. Vitafoam Nigeria Plc: +300%

The foam and mattress manufacturer tripled investor returns in 2025, closing at ₦92. Strong consumer demand and improved margins drove the impressive performance.

7. Champion Breweries: +267%

Another brewing success story, Champion Breweries gained 267% as the consumer goods sector experienced a broad-based rally driven by improved earnings and renewed investor confidence.

8. Honeywell Flour Mills: +247%

The food production company delivered solid returns as consumer demand remained resilient despite broader economic pressures. Pricing power and operational efficiency improvements supported the strong performance.

9. NASCON Allied Industries: +243%

The salt and seasoning producer rounded out the consumer goods winners with a 243% gain, benefiting from stable demand for essential food products.

10. Sovereign Trust Insurance: +241%

Leading the insurance sector’s remarkable year, Sovereign Trust gained 241%. The passage of the Nigeria Insurance Industry Reform Act (NIIRA 2025) catalyzed a sector-wide rally as investors anticipated stronger, better-capitalized companies emerging from the new regulatory framework.

Performance by Sector

Banking Sector: Wema Bank led banking stocks with a 129% gain, followed by Stanbic IBTC (+74%) and GTCO (+59%). Despite trading at steep discounts to book value, Zenith Bank and UBA were trading at over 55% discounts, two tier-1 banks that remain incredibly cheap with forward P/E ratios around 4x.

Pharmaceuticals: Beyond MeCure’s standout performance, Fidson Healthcare gained 223%, and Neimeth Pharmaceuticals rose 153%. The healthcare sector demonstrated resilience as demand remained strong despite economic headwinds.

Insurance: The sector gained 65.64% overall, with the NIIRA 2025 reform act providing a powerful catalyst. The new capital requirements of ₦15 billion for non-life businesses, ₦10 billion for life, and ₦35 billion for reinsurance, are expected to create fewer but stronger players through consolidation.

NCR NIGERIA PLC. 📊📊

— UGO🦅 (@01Megad) January 1, 2026

"From small cafes to the most sophisticated banks and retailers on the planet, NCR powers the technology that integrates everything—and runs your entire operation." – NCR.

NCR is the top and best performing stock in 2025, YTD stock performance sitting at… pic.twitter.com/lLScNYdbE3

Why Consider Investing in 2026?

Several factors suggest the Nigerian market may continue to offer attractive opportunities:

1. Valuation Gap: Nigerian stocks remain significantly cheaper than emerging and frontier market peers, offering compelling value for long-term investors.

2. Reform Momentum: Policy reforms like NIIRA 2025 demonstrate government commitment to strengthening key sectors and improving market structure.

3. Improving Fundamentals: Easing forex pressures, declining FX losses for corporates, and improving consumer confidence support the case for continued earnings growth.

4. Infrastructure Development: Continued investment in infrastructure and manufacturing could benefit industrial and construction-related stocks.

5. Lower Rate Environment: If interest rates decline as expected, equities become more attractive relative to fixed income alternatives.

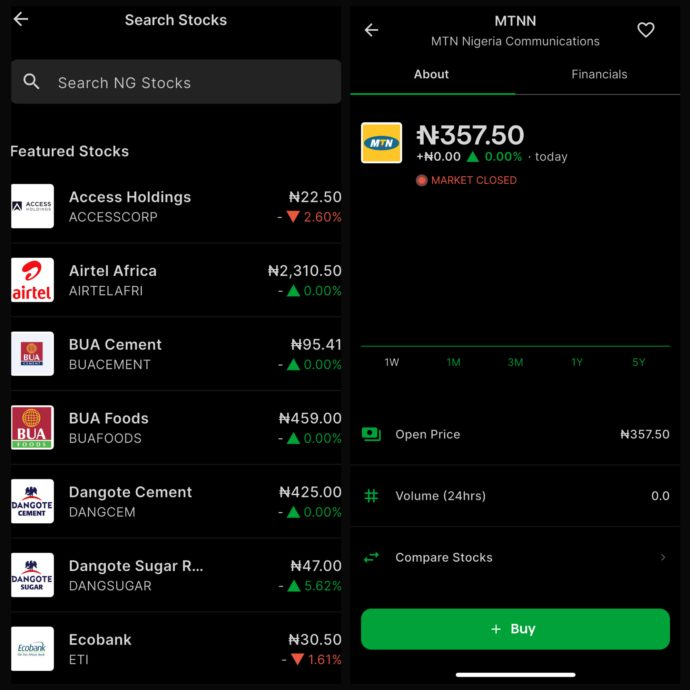

Where to Invest in Nigerian Stocks

For Nigerian investors looking to capitalize on these exceptional stock performances, several platforms provide access to the Nigerian Exchange (NGX). According to BrokerChooser.com’s latest rankings, top-rated platforms for stock trading include XTB (offering comprehensive CFD access), Capital.com, TradeZero and EasyEquities. Many of these platforms offer user-friendly interfaces, mobile apps, and competitive fee structures. Fintech apps like Bamboo, Chaka, Trove Finance, i-invest, MetaTrader 4 (MT4) & MetaTrader 5 (MT5), Cowrywise, among others allow Nigerians to invest in both foreign and local stocks.

Additionally, Nigerian investors can access these stocks through local stockbroking firms licensed by the Securities and Exchange Commission (SEC). These firms provide direct access to the NGX and offer personalized investment guidance tailored to the local market.

How to Get Started

Beginning your stock investment journey typically involves opening a trading account through licensed stockbrokers or approved online platforms. Most platforms require:

- Identity verification and KYC documentation

- Minimum deposit amounts (varying by platform)

- Bank account linking for funding

You can buy and sell Nigerian stocks during NGX trading hours (10:00 AM to 2:30 PM, Monday to Friday) just like any other securities. However, while these platforms provide tools and market access, successful stock investing requires more than just a trading account.

Professional Guidance is Essential

It’s highly recommended to work with a professional stockbroker or licensed investment advisor who can:

- Assess your risk tolerance and investment timeline

- Provide fundamental analysis of companies

- Help you build a diversified portfolio

- Navigate market volatility effectively

- Ensure compliance with Nigerian investment regulations

Remember, these platforms and tools are just instruments to execute your investment strategy, the real value comes from making informed decisions based on thorough research and professional guidance.