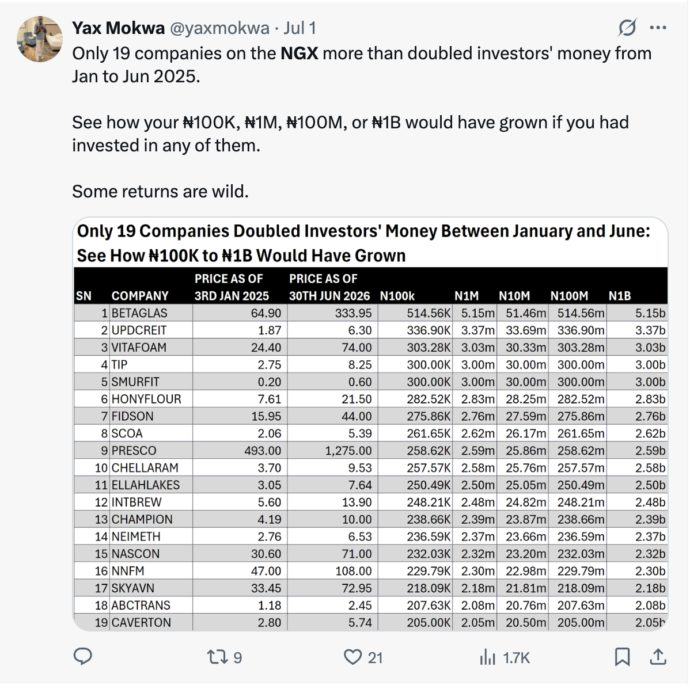

These are the top 10 Nigerian stocks that have been making millionaires on the Nigerian Exchange this year.

The Market Champions of H1 2025

The Nigerian stock market has been nothing short of spectacular in 2025, with the NGX All-Share Index climbing an impressive 16.57% in just six months. This remarkable performance has translated into massive wealth creation for investors, with market capitalization expanding by over ₦13 trillion – a testament to the resilience and growth potential of Nigerian equities.

While blue-chip giants have certainly contributed to this bullish momentum, the real stars of 2025 have been mid-cap companies that have delivered life-changing returns for early investors. These companies have not only outperformed market expectations but have also demonstrated the kind of explosive growth that can transform investment portfolios.

1. Beta Glass (BETAGLAS) – The Undisputed Winner: +414.6%

Leading the charge with an astronomical 414.6% gain, Beta Glass has been the standout performer of 2025. From a modest ₦64.90 at year-end 2024, the stock skyrocketed to ₦333.95 by June 30th. The company’s transformation has been remarkable – posting a ₦10 billion net profit in Q1 2025, representing a staggering 594% increase from the previous year’s ₦1.44 billion.

What’s particularly exciting is the company’s commitment to expansion, with CEO announcements of an additional €17.5 million investment in Nigerian operations. This isn’t just about current performance; it’s about building for the future.

2. Honeywell Flour Mills (HONYFLOUR) – The Steady Climber: +241.3%

Sometimes the most impressive gains come from consistent, steady growth. Honeywell Flour Mills exemplifies this perfectly, appreciating 241% over the first half of 2025. Starting at ₦6.3 and reaching ₦21.5, the stock has benefited significantly from the delisting of its parent company, Flour Mills of Nigeria.

The company’s return to profitability – posting ₦14.6 billion in net income for the year ending March 2025 – has validated investor confidence in its standalone potential.

3. The Initiates Plc (TIP) – The Sustainability Play: +230%

In an era where environmental consciousness drives investment decisions, waste management company The Initiates Plc has captured investor imagination with a 230% surge. Moving from ₦2.5 to ₦8.25, the company represents the growing focus on sustainable business models.

With Q1 2025 turnover hitting ₦1.2 billion (a 283% year-on-year jump), TIP demonstrates that sustainability and profitability can go hand in hand.

4. Vitafoam Plc (VITAFOAM) – The Turnaround Story: +221.7%

Nothing excites investors more than a successful turnaround, and Vitafoam has delivered exactly that. Surging 221.7% from ₦23 to ₦74, the company transformed a ₦5.58 billion net loss in H1 2024 into a ₦6.7 billion profit in H1 2025.

This dramatic reversal showcases management’s ability to execute strategic changes and return value to shareholders.

5. Smart Products (SMURFIT) – The Dividend Darling: +200%

While a 200% gain from 20 kobo to 60 kobo might seem modest in absolute terms, Smart Products has caught the attention of income-focused investors. The real estate company’s impressive 40% dividend yield in 2024 makes it a compelling choice for those seeking regular income alongside capital appreciation.

Healthcare Sector Dominance

The pharmaceutical sector has been particularly strong, with two companies making the top 10:

6. Neimeth International Pharmaceuticals (NEIMETH): +185.2%

As the best-performing healthcare stock, Neimeth’s 185% gain from N2.29 to N6.53 reflects the sector’s growing importance. The company’s 114% growth in operating profit demonstrates operational efficiency improvements.

7. Fidson Healthcare (FIDSON): +183.9%

Following closely, Fidson’s 184% appreciation from N15.50 to N44.00 was driven by spectacular financial results, including a 213.5% increase in Q1 net income to N3.25 billion.

Industrial Giants Making Moves

8. Presco Plc (PRESCO) – The Market Cap King: +168.4%

Presco stands out not just for its 168.4% gain, but for adding approximately N800 billion in market capitalization – the largest absolute gain among all stocks. With revenue jumping 120% to N93.8 billion in Q1 2025, Presco continues its incredible five-year run that has seen shares appreciate nearly 2,600% since 2020.

9. Champion Breweries (CHAMPION) – The Profitable Brewer: +162.5%

In a challenging brewing sector, Champion has distinguished itself as the only consistently profitable brewer since 2023. The 162.5% surge from N3.81 to N10.00 was fueled by a remarkable turnaround from a N823.8 million loss to a N984.6 million profit in Q1.

10. SCOA Nigeria (SCOA) – The Political Connection: +161.7%

SCOA’s 161.7% gain from N2.06 to N5.39 demonstrates how external factors can influence stock performance. The company benefited from heightened attention due to CEO Massad Boulos’ connections to U.S. President Donald Trump, with shares surging 75% during Trump’s inauguration week alone.

Explore Another Investment Opportunity Making Nigerians Rich in 2025: The ETFs Making Nigerians Rich in 2025 and How to Invest

Investment Considerations

While these returns are impressive, it’s crucial to remember that past performance doesn’t guarantee future results. The Nigerian market’s volatility means these high-flying stocks can experience significant corrections. Successful investing requires:

- Thorough fundamental analysis

- Risk diversification

- Long-term perspective

- Professional guidance when needed

Where to Invest in Nigerian Stocks

For Nigerian investors looking to capitalize on these exceptional stock performances, several platforms provide access to the Nigerian Exchange (NGX). According to BrokerChooser.com’s latest rankings, top-rated platforms for stock trading include XTB (offering comprehensive CFD access), Capital.com, TradeZero and EasyEquities. Many of these platforms offer user-friendly interfaces, mobile apps, and competitive fee structures. Fintech apps like Bamboo, Chaka, Trove Finance, i-invest, MetaTrader 4 (MT4) & MetaTrader 5 (MT5), Cowrywise, among others allow Nigerians to invest in both foreign and local stocks.

Additionally, Nigerian investors can access these stocks through local stockbroking firms licensed by the Securities and Exchange Commission (SEC). These firms provide direct access to the NGX and offer personalized investment guidance tailored to the local market.

How to Get Started

Beginning your stock investment journey typically involves opening a trading account through licensed stockbrokers or approved online platforms. Most platforms require:

- Identity verification and KYC documentation

- Minimum deposit amounts (varying by platform)

- Bank account linking for funding

You can buy and sell Nigerian stocks during NGX trading hours (10:00 AM to 2:30 PM, Monday to Friday) just like any other securities. However, while these platforms provide tools and market access, successful stock investing requires more than just a trading account.

Professional Guidance is Essential

It’s highly recommended to work with a professional stockbroker or licensed investment advisor who can:

- Assess your risk tolerance and investment timeline

- Provide fundamental analysis of companies

- Help you build a diversified portfolio

- Navigate market volatility effectively

- Ensure compliance with Nigerian investment regulations

Remember, these platforms and tools are just instruments to execute your investment strategy, the real value comes from making informed decisions based on thorough research and professional guidance.

Going Forward

The first half of 2025 has shown that Nigerian stocks can deliver exceptional returns for investors willing to do their homework and take calculated risks. As we move into the second half of the year, these companies will need to demonstrate that their gains are supported by sustainable business fundamentals rather than just market euphoria.

For investors looking to participate in Nigeria’s growth story, these top performers offer valuable insights into sectors and companies driving the market’s impressive performance. However, remember that successful investing is about building a balanced portfolio aligned with your risk tolerance and investment goals.

Important Disclaimer

Investment Warning: The value of investments can fall as well as rise, and you could get back less than you invest. Past performance is not indicative of future results. Stock investments carry market risk, and investors should carefully consider their risk tolerance and investment objectives before investing.

This information is for educational purposes only and should not be considered as personalized investment advice. Before making any investment decisions, consider consulting with a qualified financial advisor or licensed stockbroker who can assess your individual circumstances and goals.