While individual stock picking can be rewarding, it requires significant time, expertise and risk tolerance that many investors simply don’t possess. Mutual funds shine offer a professionally managed, diversified investment solution that pools resources from multiple investors to achieve superior returns while spreading risk across various assets.

Here are Nigeria’s top 10 mutual funds that delivered massive returns for H1, 2025 and how you can get started investing in any of them.

What Are Mutual Funds And How Do they Work?

A mutual fund is essentially a collective investment vehicle where money from numerous investors is pooled together and managed by professional fund managers. These experts use their knowledge, research capabilities and market insights to invest in a diversified portfolio of stocks, bonds, and other securities on behalf of investors. For their services, they charge you fees when you invest and also charge a fee when they make a profit on your investment. While it varies, managers can charge fees between 2% – 5% of the value of the investment.

Think of it as hiring a team of investment professionals to manage your money alongside thousands of other investors. This approach offers several key advantages: professional management, diversification across multiple assets, economies of scale that reduce individual costs, and accessibility with relatively low minimum investments.

Unlike ETFs that passively track market indices, most mutual funds are actively managed, meaning fund managers make strategic decisions about which securities to buy, hold, or sell based on market conditions and investment objectives. This active approach aims to outperform market benchmarks through skilled stock selection and timing.

Nigeria’s Mutual Fund Success Story in 2025

The Nigerian mutual fund industry has delivered exceptional performance in the first half of 2025, with the top 10 funds all generating returns exceeding 30% – well above the current inflation rate of 22.9%. This means investors are not only preserving their purchasing power but building real wealth.

This outstanding performance is largely attributed to the strong showing of the Nigerian Exchange (NGX), which advanced 16.57% during the same period. However, skilled fund managers have amplified these gains through strategic asset allocation and security selection.

Top 10 Mutual Funds of H1 2025

1. Halo Equity Fund – 90% Returns

Leading the pack with an extraordinary 90% return, Halo Asset Management Limited’s flagship fund focuses on capital appreciation through high-risk equity investments across various sectors. With a long-term investment horizon, this fund demonstrates how aggressive equity strategies can deliver exceptional results when markets perform well.

2. Alpha Morgan Balanced Fund – 67.84% Returns

Alpha Morgan Capital Managers Limited achieved impressive diversification benefits, blending equity securities from the NGX with high-quality fixed-income securities. This balanced approach delivered 67.84% returns while managing risk through asset class diversification.

3. Coral Balanced Fund – 67.70% Returns

FSDH Asset Management’s actively managed fund invests a maximum of 65% in NGX equities with the remainder in fixed-income securities. This strategic allocation framework generated 67.70% returns, proving that disciplined asset allocation can produce outstanding results.

4. Guaranty Trust Equity Income Fund – 56.21% Returns

Focusing on dividend-paying stocks, this fund from Guaranty Trust Fund Managers delivered 56.21% returns while providing income-seeking investors with regular dividend distributions. It’s an excellent choice for those wanting growth plus income.

5. Zrosk Magna Equity Fund – 42.34% Returns

Zrosk Investment Management’s high-conviction equity approach, leveraging expert insights to identify stocks aligned with client goals, produced solid 42.34% returns through focused stock selection.

Balanced and Ethical Investing Options

6. Paramount Equity Fund – 40.66% Returns

As Nigeria’s oldest mutual fund, Chapel Hill Denham’s Paramount Fund continues proving its staying power with 40.66% returns. Its broad-based approach to high-quality equities and fixed-income securities offers consistent long-term capital appreciation.

7. Stanbic IBTC Imaan Fund – 40.49% Returns

For investors seeking Sharia-compliant investing, this fund achieved 40.49% returns while adhering to Islamic investment principles. With minimum 70% allocation to Shariah-compliant equities and up to 30% in instruments like Sukuks, it proves ethical investing doesn’t compromise returns.

8. Balanced Strategy Fund – 36.32% Returns

This medium-to-high risk fund delivered 36.32% returns through diversified investments in NGX-listed companies, government and corporate bonds, plus money market securities for stability.

9. ESG Impact Fund – 35.71% Returns

Quantum Zenith’s ESG Impact Fund generated 35.71% returns while focusing on socially responsible investments. Allocating 40-60% each to equities and bonds, with 5-20% in money market securities, it demonstrates that sustainable investing can deliver competitive returns.

10. ARM Halal Balanced Fund – 35.68% Returns

Rounding out the top 10, ARM Investment Managers’ Sharia-compliant balanced fund achieved 35.68% returns with 51.22% equity allocation and 48.78% in alternative investments, all meeting Islamic investment criteria.

How to Invest in Nigerian Mutual Funds

Getting started with mutual fund investing is straightforward. Most funds accept minimum investments of ₦10,000, making them accessible to a broad range of investors. You can invest through:

Licensed Asset Management Companies: Contact fund managers directly through their offices or websites to open accounts and make investments.

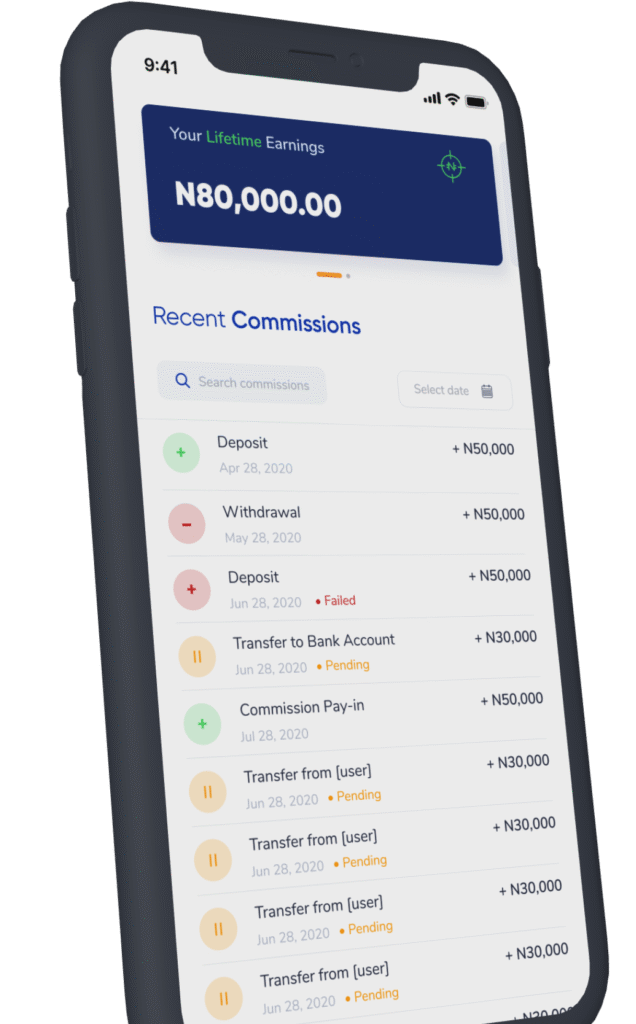

Commercial Banks: Many banks offer mutual fund products from various asset management firms that provide convenient one-stop investment solutions. Some of them offer access to their mutual funds in their apps.

Online Platforms: Digital investment platforms increasingly offer mutual fund access with user-friendly interfaces and automated investment options. Fintech platforms sometimes list mutual funds that allow their users to invest. For instance, ARM is listed on Cowrywise.

Financial Advisors: Professional advisors can help assess your risk tolerance, investment timeline and recommend appropriate funds for your situation.

Investment Process

Opening a mutual fund account typically requires:

- Choose your preferred fund

- Decide on your investment goals

- Completed application forms and risk assessment

- Valid identification and proof of address

- Bank account details for transactions

- Minimum initial investment amount

Once your account is established, you can make additional investments, set up automatic investment plans and monitor your portfolio performance through regular statements and online portals.

Important Investment Considerations

While these outstanding returns are encouraging, successful mutual fund investing requires understanding that past performance doesn’t guarantee future results. Consider these factors:

- Risk Assessment: Equity funds offer higher return potential but greater volatility than balanced or fixed-income funds

- Investment Timeline: Mutual funds work best as medium to long-term investments (3+ years)

- Diversification: Consider spreading investments across different fund types and managers though over-diversification can increase the operational costs of a fund and diminish the benefits of diversification.

- Fees: Understand management fees and how they impact your returns

- Regular Monitoring: Review fund performance and rebalance as needed

Professional Guidance Is Always Recommended

While mutual funds offer professional management, selecting the right funds for your circumstances benefits from additional professional advice. Licensed investment advisors can help you:

- Assess your risk tolerance and investment objectives

- Choose appropriate funds based on your timeline and goals

- Create a diversified fund portfolio

- Monitor and adjust your investments as circumstances change

Disclaimer

Investment Warning: The value of mutual fund investments can fall as well as rise, and you may get back less than you invest. Past performance is not indicative of future results. All investments carry risk, and you should carefully consider your risk tolerance and investment objectives before investing.

This information is for educational purposes only and should not be considered personalized investment advice. Before making investment decisions, consult with licensed financial professionals who can assess your individual circumstances and goals.