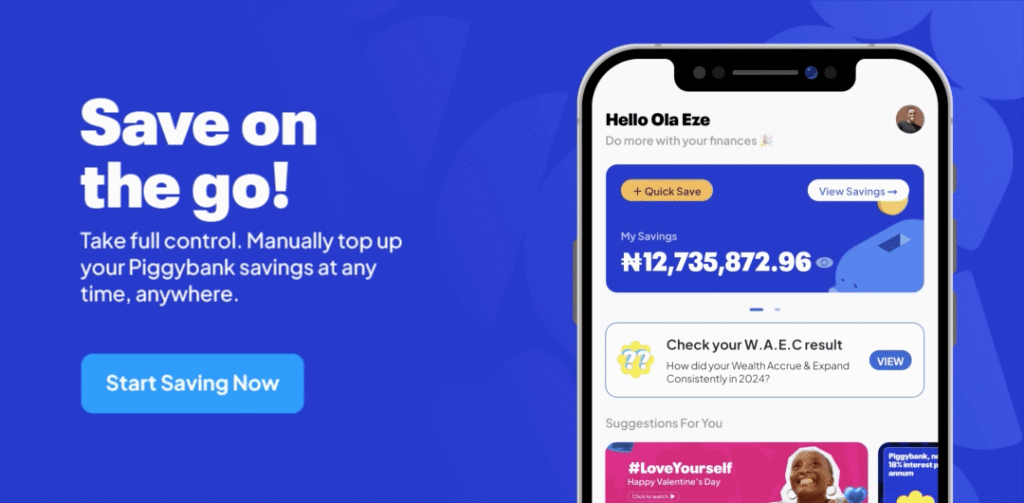

Here’s how to fund your Piggyvest account as a beginner and join over 5.5 million Nigerians saving and investing on the CBN-licensed platform.

What Piggyvest Offers

Piggyvest is Nigeria’s leading digital savings and investment platform which helps money-conscious Nigerians take control of their finances with ease. Whether you’re looking to build an emergency fund, save for specific goals, or explore low-risk investment opportunities, Piggyvest offers a comprehensive suite of financial tools designed for the modern Nigerian.

Piggyvest provides six distinct savings plans and one investment feature:

- PiggyBank: Automated savings with up to 18% annual interest

- Safelock: Fixed savings for specific periods with up to 21% annual returns

- Target Savings: Goal-oriented saving for individuals and groups with 12% annual interest

- Flex Naira: Emergency fund building with up to 12% returns and four free monthly withdrawals

- Flex Dollar: Foreign currency savings that allows you to earn up 7% annually

- HouseMoney™: Dedicated rent and household bill savings with 14% yearly interest

- Investify: Investment opportunities with potential returns up to 35% annually

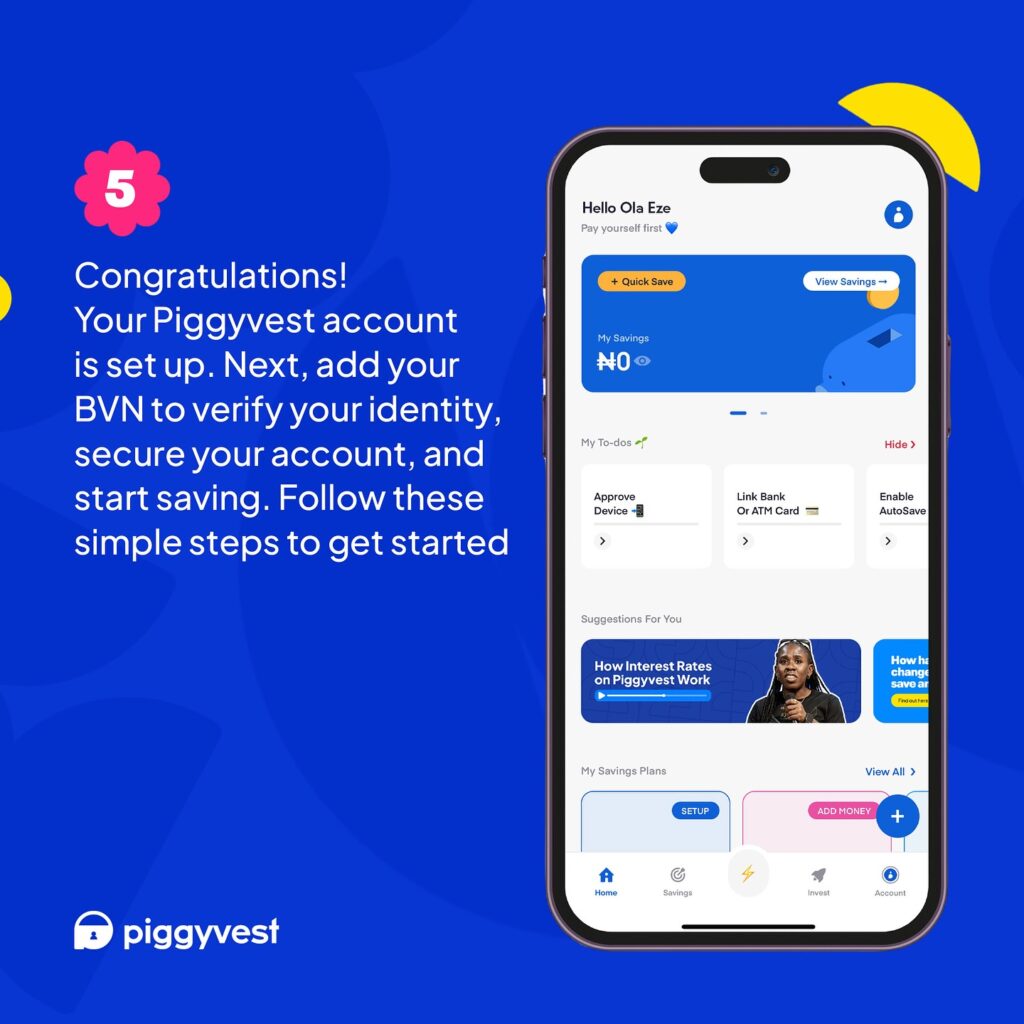

Getting Started: Account Setup

Step 1: Download and Install the App

Download the Piggyvest app from your device’s app store (available on both iOS and Android). The mobile app serves as your primary interface for all savings and investment activities.

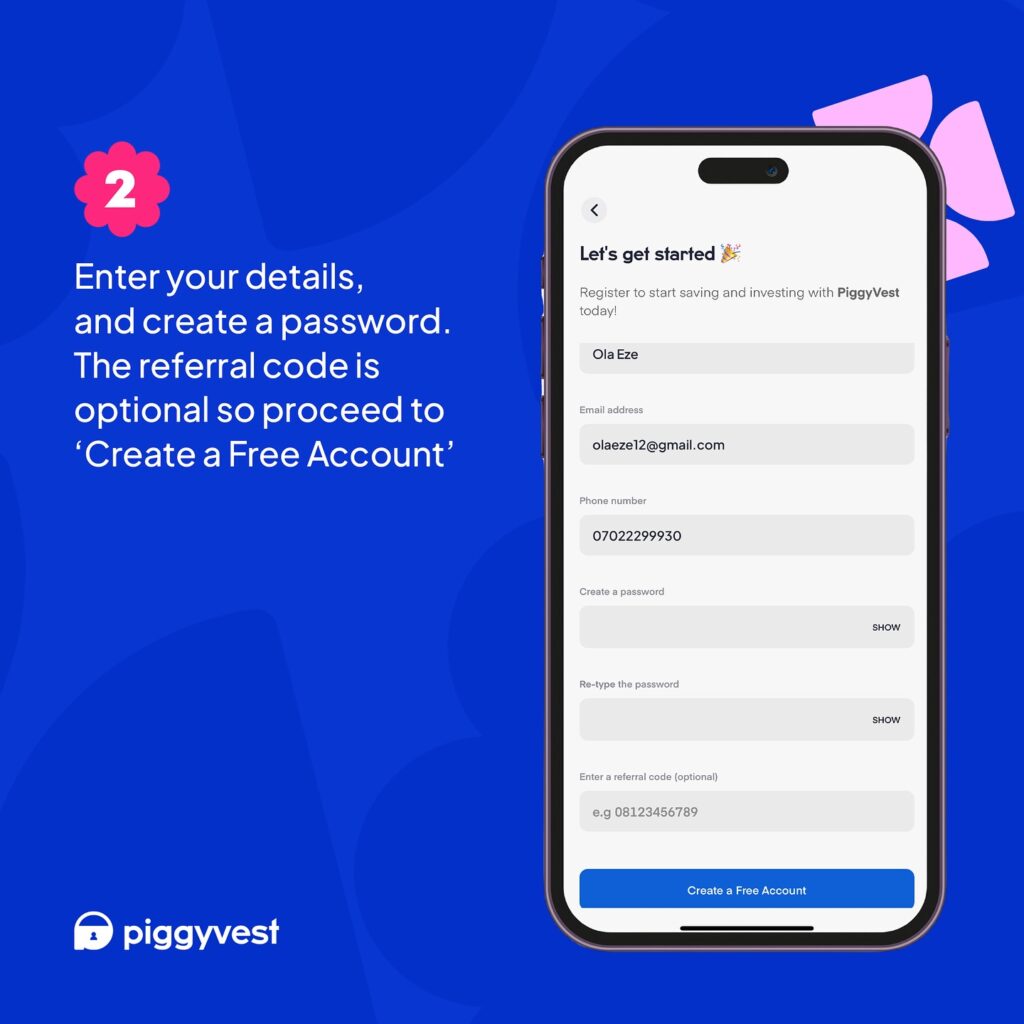

Step 2: Create Your Account

Open the app and follow the registration process. You’ll need to provide basic personal information including your name, email address and phone number. Ensure you use accurate details as these will be verified later.

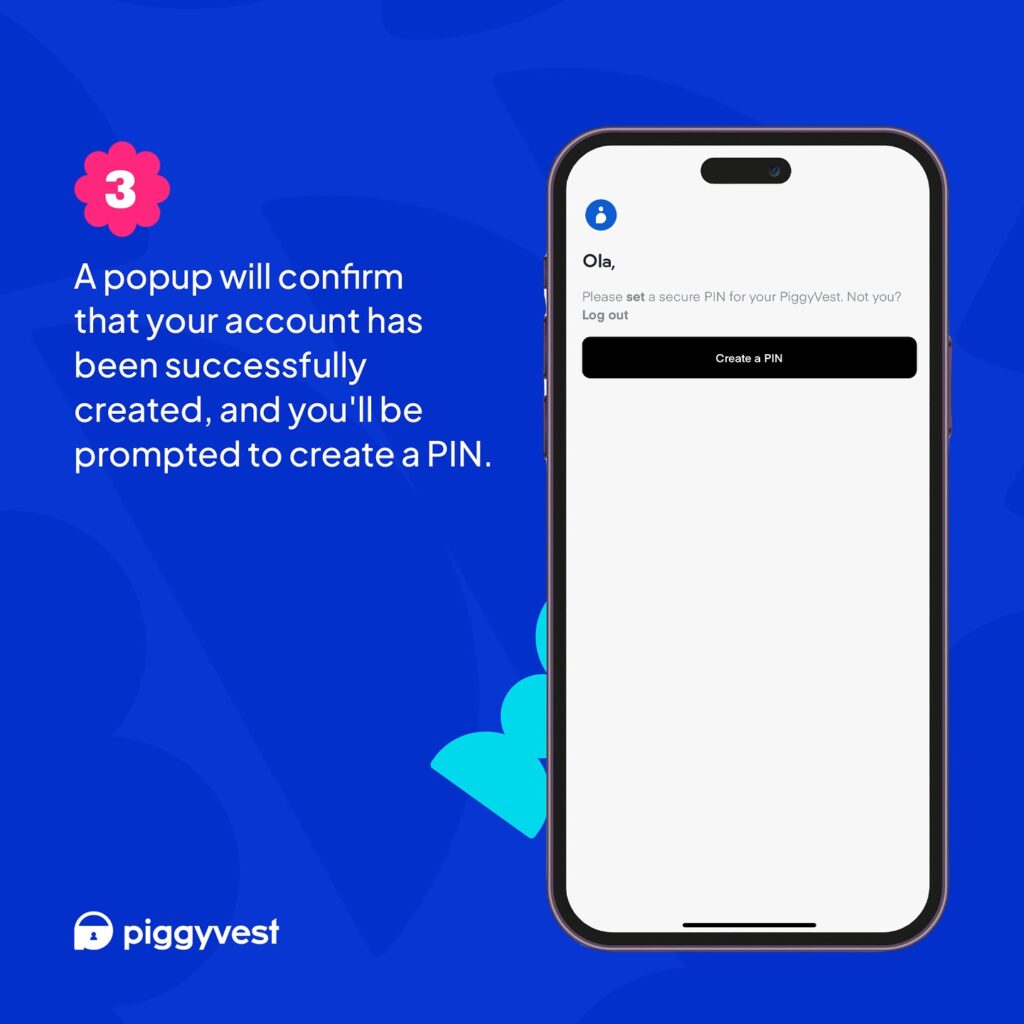

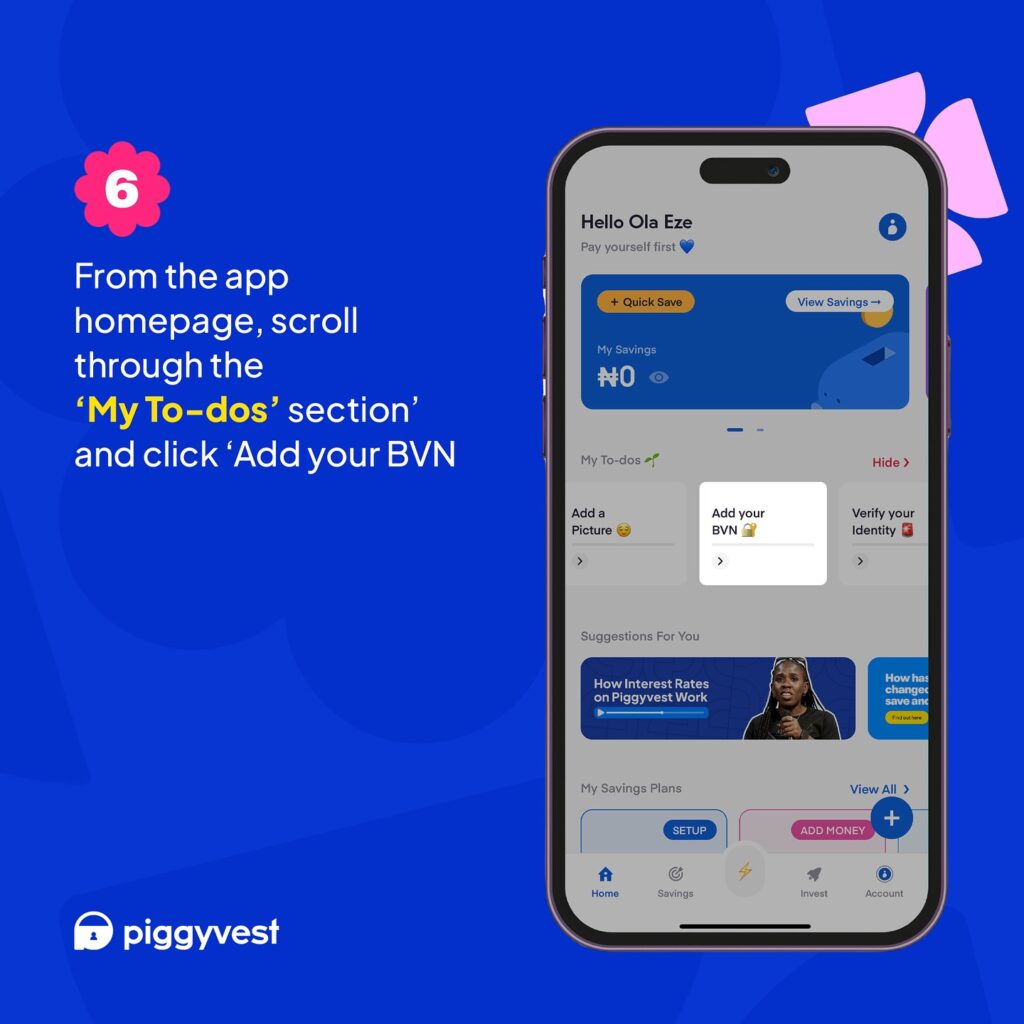

Step 3: Link Your BVN

For security and compliance purposes, you’ll need to link your Bank Verification Number (BVN). This step is crucial for accessing features like Flex Naira and enables seamless transactions between your regular bank accounts and Piggyvest.

Step 4: Verify Your Identity

Complete the identity verification process by uploading required documents. This typically includes a government-issued ID and may require additional verification steps.

Setting Up Your First Savings Plan: PiggyBank

PiggyBank is the perfect starting point for new users. It’s Piggyvest’s flagship automated savings feature that helps you save consistently without thinking about it. It is also the most popular savings plan on the platform

How to Enable AutoSave

- Log into your Piggyvest app

- Navigate to “Savings”

- Click on “PiggyBank”

- Select “Enable AutoSave”

- Go to “Settings” and select “AutoSave Settings”

- Configure your savings plan: Choose your preferred amount (start small with ₦500-₦1,000 if you’re new to saving)

- Select frequency: Daily, weekly, or monthly options are available

- Choose your funding source: Link your bank account or debit card

- Set preferred time: Pick when you want the automatic deduction to occur

- Select start date: Choose when you want your automated savings to begin

- Click “Complete” to activate

How to Use Quick Save for Manual Deposits

Not ready for automated savings? Use Quick Save for flexible, manual contributions:

- Click on “Quick Save” within PiggyBank

- Enter the amount you want to save

- Select your source of funds

- Click “Quick Save” to complete

This feature is perfect for irregular income earners like traders or business owners who prefer controlling when they save.

Ways You Can Fund Your Account

1. Bank Transfer Method

Once your account is set up, funding is straightforward. For most savings plans like Flex Naira and HouseMoney™, you’ll receive a dedicated account number. Simply transfer funds from your regular bank account to this number using your bank’s app or internet banking platform.

2. Debit Card Funding

For immediate funding, you can use your debit card directly through the app. This method is particularly useful for quick saves or when you want to fund specific savings goals immediately.

3. Direct Debit Setup

For automated savings plans, set up direct debit authorization. This allows Piggyvest to automatically deduct your specified savings amount from your linked bank account according to your chosen schedule.

Pro Tips to Grow Your Money Faster

Save Before You Spend: Set up automated savings to trigger immediately after receiving your salary. This “pay yourself first” approach ensures you save before expenses eat into your income.

Use Safelock for Higher Returns: For money you won’t need for at least 10 days, use Safelock to earn up to 21% annual interest, a significantly higher rate than regular savings accounts.

Diversify Your Investments: Don’t put all your money in one savings plan. Explore Investify options to build a balanced portfolio and potentially earn up to 35% annual returns through low-to-medium risk investments.

Take Advantage of Referral Bonuses: Invite friends to join Piggyvest and earn extra cash through their referral program. It’s free money for spreading the word about financial wellness.

Start Small: Begin with amounts you’re comfortable with. Even ₦500 weekly can build substantial savings over time with compound interest.

Choose the Right Plan: Match your savings plan to your goals. Use Safelock for money you won’t need soon, Target Savings for specific goals, and Flex Naira for emergency funds.

Monitor Your Progress: Regularly check your app to track your savings growth and interest earnings.

Gradually Increase: As you become comfortable with automated savings, gradually increase your contributions to accelerate your financial goals.

With your Piggyvest account properly set up, you’re now equipped to take control of your financial future. The platform’s user-friendly interface and diverse savings options make it easy to build wealth consistently, regardless of your income level or financial experience.

With your Piggyvest account properly set up, you’re now equipped to take control of your financial future. The platform’s user-friendly interface and diverse savings options make it easy to build wealth consistently, regardless of your income level or financial experience.