Thanks to loan apps, Nigerians can now easily apply for a loan using just a smartphone. Many people with unplanned expenses can now get credit in a few minutes. However, these loan apps have obvious but often neglected downsides that can hinder your financial growth, dent your reputation and negatively impact your mental health.

Why Loan Apps Are Irresistible

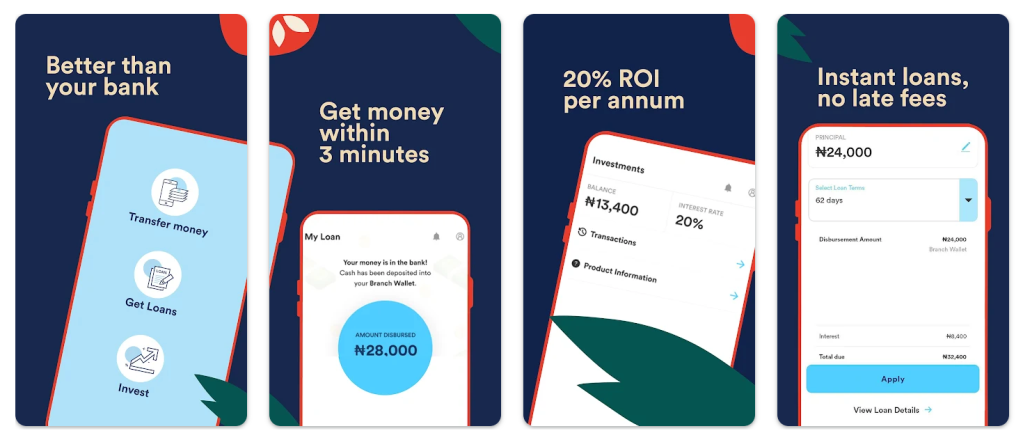

In Nigeria, with the explosion of fintech apps, getting a loan has never been easier. Gone are the days when you needed to dress up formally, go to the bank with some documents, which mostly includes referees and collateral, and endure long queues in banking halls. Today, with just a smartphone and internet connection, you can easily receive a loan in your account within minutes.

This ease of access has made fintech loan apps incredibly popular among Nigerians. Unlike traditional banks that require collateral, referees, lengthy approval processes and physical visits, these apps operate entirely online with minimal requirements, usually just your phone number, BVN and employment details. No wonder millions of Nigerians have embraced them.

But behind this convenience lies a darker reality that many borrowers discover only a little too late. The very features that make these apps attractive, such as instant approval, minimal documentation, easy access, can quickly transform from solutions into serious problems that trap users in cycles of debt, harassment and financial ruin.

Two Nigerians Caught In Debt Traps Tell their Stories

How Kenneth’s Small Loans Became Big Problems

Kenneth Chidiebere, a 33-year-old aspiring cinematographer, thought he was making a smart financial move in January when he needed quick cash to fund his dream course. A client’s delayed payment had left him stranded, and loan apps seemed like the perfect bridge financing solution.

In December 2024, in a lengthy expose, he would tell The Nation Newspaper: “I was expecting some cash from my client and it took longer than expected. That was where the idea came to try a loan app and pay back when the client paid,” Kenneth recalled. The plan seemed foolproof: he would borrow small amounts and then pay back quickly when the client settled. Initially, things went well. Kenneth successfully repaid his first three loans on time. But when his client continued to delay payment, he found himself caught in a web of borrowing from multiple apps to stay afloat in his cinematography classes.

The numbers tell a sobering story. From Quick Credit, Kenneth borrowed ₦65,000 and was supposed to repay ₦93,000 in just 7 days. When he couldn’t meet the impossibly short deadline, the debt exploded. “It was 30 days late and so, the overdue charges grew to ₦65,000. I had to pay a total of ₦158,000, which included the initially ₦93,000 I was supposed to pay and the overdue charge of ₦65,000,” he explained.

The situation spiralled further with Kash Credit, where a ₦55,000 loan that required ₦84,000 repayment in 7 days became ₦140,000 after 20 days of being overdue. “The interest rate for this was ₦26,000 if you subtract ₦55,000 from ₦84,000,” Kenneth calculated, revealing how a simple ₦26,000 interest became a crushing ₦84,000 debt.

What started as borrowing from one app to pay another eventually saw Kenneth trapped across more than 20 loan apps. An initial debt of about ₦65,000 had mushroomed into over ₦1.2 million. In desperation, he sold his car for ₦1.7 million to clear all debts and regain his peace of mind. “I couldn’t deal with the harassment and the effect it was having on my mental state anymore. So, I decided to sell my car to clear up all the debts and start on a clean slate,” he said. Kenneth’s story illustrates how quickly small, seemingly manageable loans can spiral into life-altering debt when coupled with predatory interest rates and unrealistic repayment timelines.

When Debt Collectors Bullied Shayo Online

Twenty-eight-year-old Shayo Adebayo, an unemployed medical physiology graduate, experienced the psychological warfare that loan apps employ when borrowers struggle to repay. She would tell The Guardian in 2022, that her ordeal began innocuously, mostly taking regular ₦40,000 loans to cover transport and food until payday. But when she lost her job in October, her world turned upside down.

According to her, the harassment was relentless and calculating. Debt collectors sent a barrage of abusive messages: “I will destroy your life,” read one WhatsApp message shown to The Guardian. “I want to see your payment or else all hell will be let loose,” threatened another.

The most chilling of the messages simply said “enjoy your shame”. This was sent after the loan company had already broadcasted her details to everyone in her contact list and attached her Facebook photos to messages calling her a fraud and thief. “By the time you take the loan, you’re basically naked. They know everything about you,” Shayo explained to The Guardian. The loan application process had required access to her contacts, social media accounts, family and friends’ details, workplace, church, and home address. “So when you’re not able to pay, they start working on those contacts.”

The psychological impact was devastating. The constant stream of abusive messages and the public humiliation drove Shayo to suicidal thoughts. “Their weapon is your shame,” she observed. “That’s why they do it. They use that to get to you.” Between October and December, desperation led Shayo to download 32 different loan applications as she struggled to cover her debts. “First I was borrowing just to make it to the end of the month,” she said. “Then I was borrowing to pay back the loan, then borrowing more to pay that one and on and on.”

Here’s Why You Should Think Twice Before Borrowing

1. Debt Traps and Multiple Loans From Different Loan Apps

The convenience of using loan application tools in Nigeria is what makes it particularly concerning. The old hurdles meant that more thought went into deciding and seeking out credit. Besides, these hurdles made loans one among many alternatives. But the ease of access made them has made them the first port of call for many Nigerians in search of credit. And without any real alternatives, many find themselves cycling through as many of those apps as possible.

The ease means that the process often precludes significant and extensive reflection. In this state, we become blind to the ridiculous interest rates and instead of addressing our financial issues by building sources of income, we develop an inordinate reliance on these apps.

2. Extremely High Interest Rates and Hidden Fees

The interest rates of most of these loan apps in Nigeria are extremely high. Many Nigerians take loans from these loan apps without paying attention to the interest rates. The majority of them charge annual percentage rates (APR) between 34% to 271%. Beyond interest, these apps also include hidden charges such as processing fees, late payment penalties and even early repayment charges. These costs are often buried in the terms and conditions, which most users never bother to read.

3. Potential Misuse of Your Personal Data

These loan apps often have access to your personal data such as your contacts and photos. Some of them would misuse borrowers’ information to embarrass them on social media. They harass borrowers who couldn’t pay their debt with calls, messages, with some going as far as posting their pictures online. This can affect your relationships as well as damage your reputation.

4. Unrealistic Due Dates For Loan Repayment

All the quick loan apps in Nigeria have a short repayment period for borrowers. The repayment plan option is between 7 – 30 days. Such a tight period will put you under financial pressure when you are unable to make a payment on or before the due date, especially when there are other more pressing commitments and responsibilities to take care of.

Ask Yourself these Questions Before Borrowing

If you are considering borrowing from any of those loan apps, these are some questions you must reflect on

- Do I really need this money right now, or can I wait?

- What is my realistic repayment plan?

- Have I calculated the total cost including all fees and charges?

- Are there safer alternatives like savings, family support or traditional bank loans?

- Can I afford to lose the privacy and personal data that these apps will access?

In the end, what most Nigerians need is financial freedom. And true financial freedom comes from building sustainable money creation and management habits, not from easy access to credit.