The NGX Premium Index stocks are stocks with large capitalization, strong institutional backing, transparent operations and robust trading volumes. Here are the top-performing NGX Premium stocks of 2025 to keep an eye on in 2026.

2025: A Massive Year for Nigerian Equities

The Nigerian equity market delivered one of its most impressive performances in recent history in 2025 and closed the year with a remarkable 51.19% return. This marked the best full-year performance since 2007, when the market gained 74.74%. The Nigerian Exchange All-Share Index closed at an unprecedented 155,613.03 points, while total market capitalization surged by ₦36.62 trillion to reach ₦99.4 trillion, up from ₦62.76 trillion in 2024.

What made 2025 particularly noteworthy was the breadth of the rally. Over 45 listed companies posted gains exceeding 100%, with some delivering returns above 1,000%. Consumer goods stocks surged 129.57%, insurance stocks climbed 65.64%, and industrial goods rose 58.91%. Even the banking sector managed a respectable 39.77% gain despite mid-year headwinds from Central Bank of Nigeria directives.

The NGX Premium Index tracks companies with strong governance and liquidity standards. It outperformed the broader market with a 59.40% gain, and rose from 9,719.8 points to 15,493.2 points. This sub-index maintains strict requirements: companies must have at least ₦40 billion in free float, ₦200 billion market capitalization, and a 70% governance score to qualify for inclusion.

Understanding Premium Stocks

Before diving into our list, it’s worth understanding what makes these stocks “premium.” The NGX Premium Index represents the exchange’s most liquid and well-governed companies. These are typically large-cap stocks with strong institutional backing, transparent operations, and robust trading volumes. While they may not always deliver the explosive returns of smaller-cap stocks (for instance, NCR Nigeria gained 1,354% in 2025, for instance), premium stocks offer a combination of stability, liquidity, and growth potential that makes them attractive for serious investors.

The Best-Performing Premium Stocks of 2025

Here are the six premium stocks that led the market in 2025, based on their exceptional year-to-date performance:

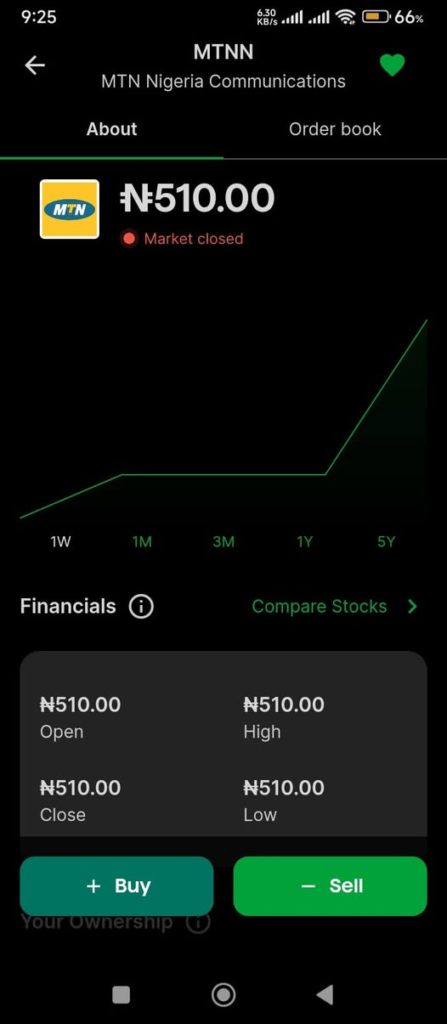

MTN Nigeria Communications: +155.50%

MTN Nigeria emerged as the undisputed leader among premium stocks, surging 155.50% to close at ₦511 from ₦200, marking its highest-ever price. The telecommunications giant’s market capitalization now stands at ₦10.72 trillion, representing 10.73% of the entire Nigerian Exchange market.

The company’s remarkable turnaround was driven by strong fundamentals. After posting a ₦713.6 billion loss in 2024, MTN recovered to deliver a nine-month pre-tax profit of ₦1.12 trillion in 2025. Revenue hit ₦3.73 trillion, with data services leading the charge. Data revenue grew 73% year-on-year to ₦1.97 trillion, contributing over 53% of total revenue as Nigerians increasingly relied on mobile internet for work, entertainment, and communication.

MTN makes money primarily through voice and data services, with data becoming the dominant revenue driver as smartphone penetration deepens across Nigeria. The stock’s rally began in Q1 with a 22.5% gain, accelerated through Q2 as shares surpassed ₦300, and peaked in July at ₦472 before consolidating. An October rally pushed the stock past ₦500, where it maintained momentum through year-end.

Lafarge Africa: +92.28%

Lafarge claimed second place among premium stocks, rising 92.28% to close at ₦134.5 from ₦69.95. The cement manufacturer’s market capitalization stands at ₦2.16 trillion, representing 2.17% of the total market.

The company reported nine-month revenue of ₦780.48 billion, up 63% from ₦479.49 billion in 2024. More impressively, profit after tax soared 246% to ₦207.78 billion, driven by higher volumes, operational efficiency, and Naira stability. Lafarge generates revenue primarily through cement production and sales, benefiting from Nigeria’s ongoing infrastructure development and construction activity.

After modest gains in the first half, July proved to be the breakout month with a 70.87% surge to ₦149. Despite some volatility in subsequent months, Lafarge held above ₦130 at year-end, demonstrating resilience in a sector critical to Nigeria’s development ambitions.

First HoldCo (FBN Holdings): +70.77%

First HoldCo delivered a strong 70.77% gain, closing the year at ₦47.90 from ₦28.05. The holding company for First Bank of Nigeria posted a nine-month pre-tax profit of ₦566.5 billion. This was however, a 7.26% decrease from the previous year. Regardless, its, core performance remained solid, with net interest income after impairments jumping 72.48% year-on-year to ₦1.21 trillion. This was supported by the high-interest-rate environment.

As a banking holdco, First HoldCo generates its revenue primarily through its banking subsidiaries’ interest income from loans, fees from banking services, and investment income. The company’s market capitalization stands at ₦2.04 trillion, that is, 2.04% of the total market. The stock’s performance was characterized by a slow start, with trading remaining choppy until December when a 54.27% surge pushed shares to their year-end close of ₦47.90, just shy of the ₦50 psychological barrier.

Zenith Bank: +35.82%

Zenith Bank, one of Nigeria’s tier-1 lenders, advanced 35.82% in 2025, solidifying its position as a cornerstone of the premium index. Despite the impressive gain, Zenith Bank remains remarkably undervalued. It trades at over 55% discount to book value with a forward price-to-earnings ratio around 4x. This discount presents a compelling opportunity for value investors who believe in the long-term strength of Nigeria’s banking sector. The bank’s strong capital position, extensive branch network, and growing digital capabilities position it well for continued growth as the Nigerian economy evolves.

Dangote Cement: +27.19%

Dangote Cement, Africa’s largest cement producer, rose 27.19% to close at ₦609 from ₦478.9. The company’s market capitalization now stands at ₦10.2 trillion. This gives it 10.28% of the Nigerian Exchange market, making it one of the exchange’s heavyweight stocks.

The cement giant recorded nine-month profit before tax of ₦1.04 trillion, a staggering 156.2% increase from 2024, on revenue of ₦3.15 trillion, up 23.2%. After a slow start with Q1 gaining just 0.25% and Q2 declining over 8%, the second half powered the rally. July saw a 20% jump to ₦528.3, and by October the stock had reclaimed ₦600, up 25.69%. Trading volume surged to 248 million shares from 56 million in 2024, reflecting strong investor interest.

UBA (United Bank for Africa): +22.59%

Rounding out the premium six, UBA advanced 22.59% to close at ₦41.65 from ₦33.98. The pan-African bank reported nine-month post-tax profit of ₦537.5 billion, up 2.33% year-on-year, supported by a 10.1% rise in interest income to ₦1.98 trillion. Its market capitalization stands at ₦1.76 trillion.

Like Zenith Bank, UBA trades at a significant discount to book value (over 55%) with a forward P/E around 4x, making it attractive for investors focused on value. The stock’s journey was volatile: January opened strong with a 10.88% gain, but shares slipped to ₦35 in April. The second half drove most of the yearly performance, with July surging 40.21% to ₦49.60, though prices consolidated to ₦36.45 over the next four months before a strong December rally of 14.27% closed the year at ₦41.65.

Quick Reference List

For easy reference, here are the top six premium stocks by 2025 performance:

MTN Nigeria: +155.50% (₦511)

Lafarge Africa: +92.28% (₦134.5)

First HoldCo: +70.77% (₦47.90)

Zenith Bank: +35.82%

Dangote Cement: +27.19% (₦609)

UBA: +22.59% (₦41.65)

How to Invest in These Stocks

Nigerian investors can access these premium stocks through several channels. Licensed stockbroking firms registered with the Securities and Exchange Commission (SEC) provide direct access to the Nigerian Exchange. These firms offer personalized investment guidance and execute trades during NGX trading hours (10:00 AM to 2:30 PM, Monday to Friday).

For those preferring digital platforms, several fintech apps including Bamboo, Chaka, Trove Finance, i-invest, and Cowrywise allow Nigerians to invest in local stocks. International platforms like XTB, Capital.com, and TradeZero also offer access to Nigerian equities, though local platforms may provide better pricing and market access.

Getting started typically requires identity verification, KYC documentation, minimum deposit amounts (varying by platform), and bank account linking for funding. However, while these platforms provide the tools, successful investing requires thorough research, understanding of company fundamentals, and ideally, guidance from a licensed investment advisor who can assess your risk tolerance and help build a diversified portfolio.

Disclaimer

This article is for informational purposes only and should not be construed as investment advice. Past performance is not indicative of future results. The stock market carries inherent risks, and investors can lose money. Before you make any investment decisions, conduct thorough research and consult with a licensed financial advisor or stockbroker who can assess your individual circumstances, risk tolerance, and investment objectives. Please, always ensure that you comply with Nigerian investment regulations and only invest capital you can afford to lose.