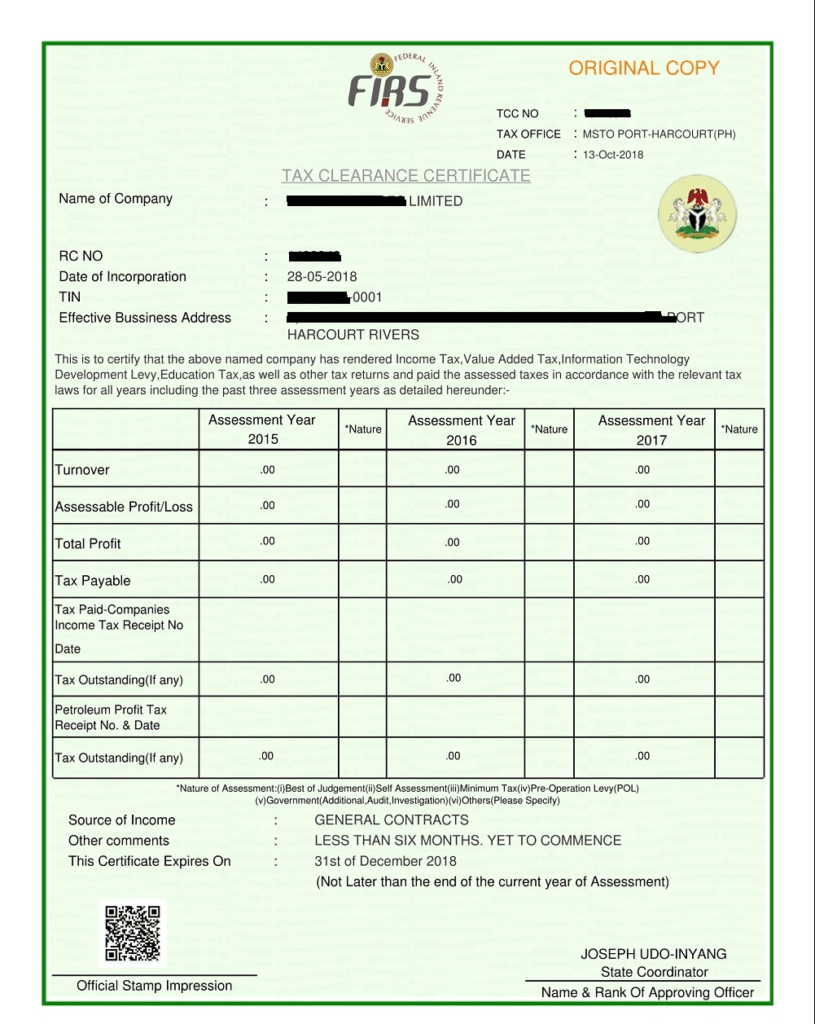

A Tax Clearance Certificates (TCC) is a document that serves as proof that you’re up to date with your tax obligations. Therefore, with the enactment of the Nigeria Tax Act 2025 and the Nigeria Tax Administration Act, 2025, it’s important to understand what this new law says about TCCs and how they affect both individuals and businesses.

What is a Tax Clearance Certificate?

A Tax Clearance Certificate is an official document that the relevant tax authority issues to certify that a taxpayer has fulfilled their tax obligations for a specified period. It’s some sorts of a clean bill of health from the tax authorities that opens doors to various opportunities and transactions.

The Nigeria Tax Act 2025 consolidates several previous tax laws into a unified framework. While they work in tandem, the Nigeria Tax Administration Act, 2025, however, primarily addresses the specific provisions for Tax Clearance Certificates.

Who Needs a Tax Clearance Certificate?

Under the new tax regime, the requirement for TCCs remains robust and far-reaching. The law recognizes different categories of taxpayers:

For Companies: Every Nigerian company, otherwise defined in Section 202 of the Act as any company “formed, registered or incorporated under any law in Nigeria” or whose “central place of management or control is Nigeria,” must maintain tax compliance. Companies are subject to corporate income tax at a rate of 30% on their total profits.

Interestingly, the Act introduces a category of “small companies,” that is, those earning gross turnover of ₦50,000,000 or less per annum with total fixed assets not exceeding ₦250,000,000, which are taxed at 0%. However, even these companies must fulfill their filing obligations to qualify for and maintain their tax-exempt status.

For Individuals, the Act establishes a progressive tax system for individuals. The rates range from 0% to 25% depending on income levels (Fourth Schedule). Individuals earning the National Minimum Wage or less are fully exempt from income tax. This, however, doesn’t eliminate the need for tax documentation in certain circumstances.

Key Situations Where You’ll Require a Tax Clearance Certificate

While the specific list of TCC requirements is detailed in the Administration Act, the Tax Act provides context through its various provisions. TCCs are typically required for:

- Government Contracts and Transactions: The Act makes several references to dealings with government entities. For instance, the Act designates Federal, State and Local Government entities as persons who “shall collect or withhold VAT on taxable supplies made to them” (Section 155). This means that TCCs would be essential in most active government procurement activities.

- Business Restructuring: The Act contains detailed provisions on business restructuring (Section 190), including mergers and transfers of businesses. Such significant corporate actions typically require evidence of tax compliance.

- Securing Loans and Credit Facilities: Although not explicitly stated in every section, the Act’s provisions on loan capital and debentures (Section 137) suggest the importance of demonstrating tax compliance in financial transactions.

- International Travel: For certain categories of travelers, particularly those on business-related trips.

- Professional Practice Registration: Many professional bodies require TCCs as part of their licensing or renewal processes.

What the Law Says About Compliance

The Tax Act emphasizes the importance of maintaining proper records and filing returns. Clearly, Section 2 of the Act states that it “applies throughout Nigeria to any person required to comply with any provision of the tax laws whether personally or on behalf of another person”.

Regarding non-resident companies engaged in shipping or air transport, the Act specifically states that “regulatory agencies in the shipping and air transport, and other relevant sectors shall, as a condition to carry on business in Nigeria or obtaining any relevant approvals or permits, mandate all persons taxable under the provisions of this section to present” evidence of tax compliance, including “Tax Clearance Certificates, showing income taxes paid for the three preceding tax years” (Section 18).

This provision demonstrates the law’s explicit use of TCCs as gatekeepers for all business operations.

How to Obtain Your Tax Clearance Certificate

The Nigeria Tax Act 2025 consolidates tax law, but the detailed procedures for obtaining a TCC are governed by the Nigeria Tax Administration Act 2025. Furthermore, the certificate will now be administered by the Nigeria Revenue Service, which replaces the Federal Inland Revenue Service. Here’s a general overview of the process:

1. Ensure You Have a Tax ID (TIN): The Act requires all taxable persons to register with the tax authority. Your TIN, now referred to as “tax ID” under the new Act, is your unique identifier in the tax system.

2. File All Outstanding Tax Returns: You must have filed all required tax returns for the period you’re seeking clearance. The Act mandates regular filing, with companies required to file annual returns and VAT-registered persons filing monthly returns.

3. Pay All Outstanding Tax Liabilities: Clear any outstanding tax debts. The Act mandates that all assessable profits, income, and taxes must be accurately calculated and paid according to the specified rates and schedules.

4. Apply Through Official Channels: Applications are typically submitted through the Nigeria Revenue Service portal or designated tax offices. You’ll need to provide documentation including evidence of tax payments, filed returns, and valid identification.

5. Processing Period: While specific timelines should be confirmed with the tax authority, the process typically takes a few weeks if all documentation is in order.

Important Considerations Under the New Act

Validity Period: TCCs are typically issued for specific periods. Accordingly, you should ensure you apply for renewal before expiration to maintain uninterrupted compliance status.

Multiple Tax Jurisdictions: The Act recognizes different “relevant tax authorities” for different taxes. For instance, the Federal Inland Revenue Service (now the Nigeria Revenue Service) administers companies income tax. State Internal Revenue Services handle personal income tax for most individuals. Depending on your circumstances, you may need clearances from multiple authorities.

Penalties for Non-Compliance: While the specific penalties are detailed in the Administration Act, the Tax Act makes clear that non-compliance has consequences. The Act empowers tax authorities to make assessments, conduct audits, and pursue collection actions.

Digital Transformation: Section 125 of the new Act embraces technology, with provisions for “electronic or digital tagging” and “electronic receipt” in stamp duties, suggesting that TCC processes may increasingly move online.

How Taxpal Can Help

Taxpal is a comprehensive tax management platform designed to simplify tax processes for individuals, corporations, and payroll companies. Taxpal offers expert guidance on how to get a TCC alongside personalized support tailored to your situation.

To get started, visit their website and choose the option that suits you best, whether it’s an in-person consultation or portal access.