If you’re looking to expand your investment horizon beyond the Nigerian Exchange (NGX), here are the best apps that make trading international stocks straightforward, secure and affordable.

1. Bamboo

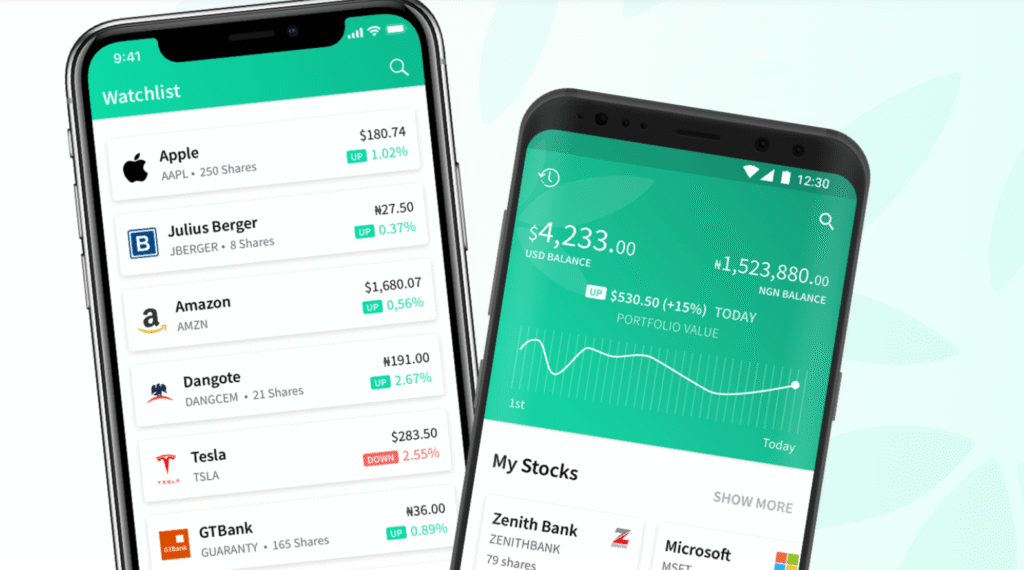

Bamboo is Nigeria’s most popular investment app, with over one million downloads and a 4.3-star rating on Google Play Store. It provides seamless access to over 3,500 U.S. stocks alongside premier NGX listings like MTN Nigeria, Access Holdings, and Nestlé Nigeria. Bamboo is ideal for investors seeking a balance between growth and security, especially those who want their dollar holdings to generate passive income while building a diversified portfolio.

Key Features

You can start trading U.S. shares with as little as $2 (approximately ₦3,000) and invest in local equities from ₦5,000. The platform offers fractional investing, meaning you don’t need to buy whole shares. This makes expensive stocks like Amazon or Google accessible to average investors. Bamboo charges a 1.5% commission on U.S. trades. Withdrawals cost ₦45 for Naira and $45 for USD.

The Main Appeal

What truly differentiates Bamboo is its Bamboo Fixed feature, which allows idle U.S. dollar balances to earn between 8–10% annually. This means your money works for you even when you’re not actively trading, providing passive income while protecting your funds from naira devaluation.

Regulation and Security

Bamboo is registered with Nigeria’s Securities and Exchange Commission (SEC) and partners with Lambeth Capital for local stock trades. For U.S. investments, accounts are protected by Securities Investor Protection Corporation (SIPC) and Financial Industry Regulatory Authority (FINRA), insuring your investments up to $500,000. The app uses two-factor authentication and AES encryption to safeguard your assets.

2. Trove Finance

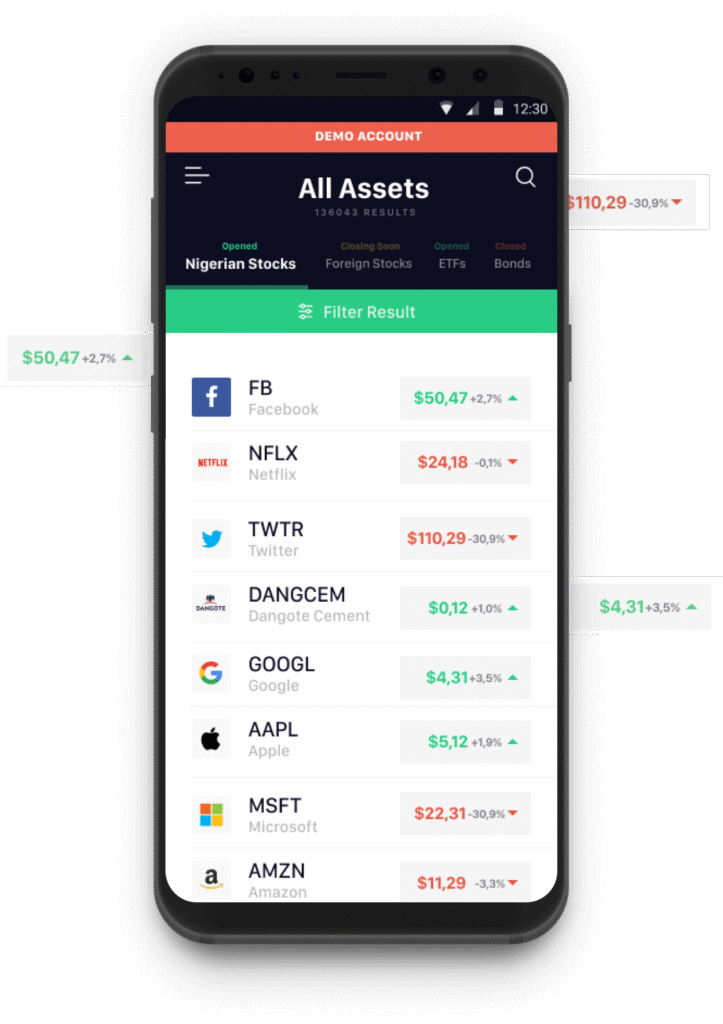

Trove Finance is remarkable for its impressive diversity and commitment to investor education. With access to over 4,000 instruments, including Nigerian, U.S., and Chinese equities, ETFs and government bonds, Trove delivers an all-in-one investment marketplace. Trove is perfect for beginners who value education alongside investment options, and for experienced investors who want access to diverse markets including China and Europe, not just the U.S. and Nigeria.

Key Features

New users can begin with just ₦1,000 or $10. The platform’s fee structure includes 1% per U.S. trade and 1.35% for NGX transactions. Card deposits attract a ₦100 plus 1.5% fee, but Naira withdrawals are free. Trove also offers features like Trove Social (a stock investment community where you can learn from other investors), Trove University (educational content for beginners), Earn by Trove (fixed-income options), USD Virtual Card and Stock Gifting.

The Main Appeal

Trove shines brightest for beginners and continuous learners. Its built-in educational resources, including Trove University with market tips and beginner-friendly content, help new investors understand what they’re buying and why. The social community feature allows you to see what other investors are doing, share insights and make more informed decisions.

Regulation and Security

For Nigerian stocks, Trove works through Sigma Securities, which registered with both SEC and NGX. For U.S. investments, they use Trove Investment Advisers, LLC, which registered with the U.S. SEC. Your U.S. account enjoys SIPC insurance coverage up to $500,000, with bank-level encryption protecting your data.

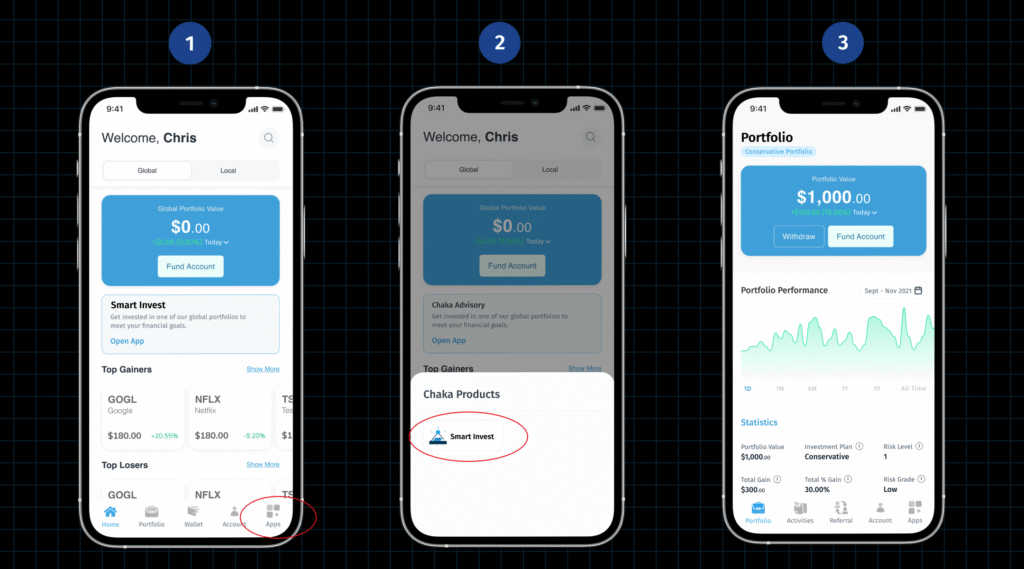

3. Chaka

Chaka was one of the first Nigerian apps to receive a digital sub-broker license from the SEC that established it as a serious, regulated platform. It provides access to over 5,000 U.S. and Nigerian stocks, global ETFs, and Nigerian treasury bills. Chaka suits cost-conscious traders who want transparent, flat-fee pricing and social investors who enjoy sharing the investment journey with friends and family.

Key Features

You need only ₦1,000 or $10 to start. Trading fees are straightforward: a flat $1 applies to U.S. trades over $200, with $2 for trades below that threshold. NGX transactions incur a 0.5% commission or ₦100, whichever is higher. Importantly, there are no deposit or withdrawal charges.

Users can open both Naira and Dollar accounts and gives flexible investment management across currencies. The platform provides real-time market data and analytics as standard features.

The Main Appeal

Chaka’s most engaging feature is its ability to gift fractional shares to anyone. Imagine introducing friends or family to investing by gifting them stocks in their favourite companies, recipients simply register and claim their gifted shares. This social element makes investing more communal and less intimidating for newcomers.

Regulation and Security

Chaka holds a digital sub-broker license from Nigeria’s SEC and processes local trades through Citi Investment Capital. The platform’s regulatory standing received a boost when Risevest acquired it, allowing both platforms to offer Nigerian stock trading under Chaka’s license.

4. Risevest

Risevest takes a fundamentally different approach from other platforms. Instead of picking individual stocks, it offers professionally managed portfolios focusing on U.S. equities, real estate investment trusts (REITs) and dollar-fixed-income products. Risevest is ideal for investors who want professionally managed international exposure, appreciate a hands-off approach and prefer steady growth over active trading.

Key Features

With a minimum investment of just $10 (approximately ₦8,000), you can access curated portfolios whose historical returns have averaged 13–14% annually. Risevest charges a management fee of 1.5–2% per year, as adjusted based on portfolio performance.

The platform focuses exclusively on U.S.-based assets and doesn’t offer Nigerian investments directly. However, its acquisition of Chaka now allows Risevest users to trade NGX stocks using Chaka’s backend infrastructure.

The Main Appeal

Risevest is perfect for passive investors who prefer to entrust their funds to professionals rather than constantly monitoring individual share movements. You select a portfolio aligned with your goals, whether growth, income or balanced, and experts handle the rest. This “set it and forget it” approach suits busy professionals who want exposure to international markets without becoming full-time traders.

Regulation and Security

Following its acquisition of Chaka, Risevest now leverages Chaka’s SEC digital sub-broker license to offer Nigerian stock trading legally. The platform operates with proper trusteeship agreements with SEC-licensed entities, including Meristem Trustees Limited.

5. Yochaa

Yochaa combines straightforward trading functionality with robust community interaction and creates an environment where investors learn from each other while building their portfolios. It suits social traders who enjoy group discussions, beginners seeking peer support, and investors who believe in learning from collective wisdom rather than going it alone.

Key Features

Users can trade NGX and U.S. stocks with fractional-share functionality starting from just $2. While specific fee details vary, Yochaa maintains a transparent pricing model you can review before each trade. Also, the app’s integrated chat forums allow investors to discuss strategies, share insights, celebrate wins, and even commiserate over losses together. This community-first approach makes investing feel less isolating.

The Main Appeal

Yochaa’s strength lies in its community features. The integrated chat forums create a space where investors can discuss market trends, ask questions, and share experiences in real-time. For new investors who might feel overwhelmed, having access to a supportive community can make all the difference between giving up and persisting.

6. PiggyVest

Originally a savings platform, PiggyVest now offers investments in real estate and bonds starting from ₦5,000, alongside its popular savings features like PiggyBank, SafeLock and Flex Dollar.

Main Appeal: Perfect for beginners who want to combine disciplined saving with investing. The easy-to-use interface and automated savings tools help build financial discipline while growing wealth.

Best For: New investors transitioning from pure savings to investments, those seeking a simple all-in-one financial management app.

7. Cowrywise

Cowrywise is a digital-first wealth management platform focusing exclusively on Naira and Dollar mutual funds with multiple savings plans. No stock options, but excellent for diversified fund investments.

Main Appeal: Investment circles let you save and invest with friends and family, creating accountability and shared financial goals. Plus, comprehensive financial planning tools and educational resources.

Security: Licensed by SEC with investments held by licensed custodians.

Best For: Investors preferring mutual funds over individual stocks, those who want to invest alongside their social circle.

8. I-invest

I-invest specializes in lower-risk, fixed-income investments including Treasury Bills, Eurobonds, commercial papers, fixed deposits and NGX shares. Start with various minimums depending on the product.

Main Appeal: Ideal for conservative investors who are seeking steady returns without high volatility. With I-invest, you earn up to 11% per annum on savings plans while accessing utility bills and airtime purchases in-app.

Security: Registered with Nigerian SEC with all investments held by licensed custodians and a 10% withholding tax applies to dividends.

Best For: Risk-averse investors who prioritize capital preservation over aggressive growth.

9. GetEquity

GetEquity offers a unique opportunity to invest in African startups from early stages to IPOs. Browse and invest in vetted startups and support innovation while gaining early equity positions.

Main Appeal: Access to venture capital and startup financing opportunities typically reserved for institutional investors. High-risk but potentially substantial rewards for those willing to support emerging companies.

Additional Options: Commercial papers, real estate projects and mutual funds beyond startup investments.

Best For: Risk-tolerant investors interested in supporting African innovation and seeking potentially high returns.

10. Crowdyvest

Crowdyvest funds impact-driven projects across agriculture, real estate and transportation sectors. Minimum investment is ₦20,000 across three portfolio options.

Main Appeal: Community-centered platform for investors who want both financial returns and social impact. Support projects that create economic development while earning competitive returns with full transparency.

Best For: Impact investors prioritizing social value alongside financial gains and for those interested in supporting community development projects.

Today, from the comfort of your smartphone, you can own shares in Apple, Tesla, Amazon and thousands of other international companies alongside local Nigerian stocks. This shift is empowering everyday Nigerians, with students, young professionals and retirees among them, to build diversified portfolios that protect against naira volatility while tapping into the growth of global tech giants and established multinational corporations.