Few Nigerians know about Fairmoney’s FlexiCredit and fewer still understand how much of a game-changer it can be. For those who borrow responsibly and sparingly, FlexiCredit may be the loan with the lowest interest rate available in the market today.

In today’s Nigeria, loan apps have become a lifeline for millions. With rising cost of living, inflation, stagnant wages and sudden emergencies, many rely on quick credit to stay afloat between paydays. But there’s a dark side: most loan apps are predatory. They lure customers with promises of convenience, then trap them in cycles of debt with high interest rates, harsh penalties and aggressive collection tactics.

A typical loan app in Nigeria charges around 30–35% interest per month. That means if you borrow ₦50,000, you may have to pay back ₦65,000 or more after just 30 days. FairMoney’s own regular loans charge 29.5% per month for one-month loans. That means if you borrow ₦50,000, you may have to pay back ₦64,750 after just 30 days.

Worse still, even if you repay early, say after two or three days, you’re still charged the full month’s interest. For people who only need money to cover a few days until salary comes in, this is devastatingly unfair.

But in this sea of predatory practices, one product stands out: FairMoney’s FlexiCredit. Few Nigerians know about it, and fewer still understand how much of a game-changer it can be. For those who borrow responsibly and sparingly, FlexiCredit may be the lowest-cost loan facility available in the market today.

What is FairMoney’s FlexiCredit?

FairMoney is already one of Nigeria’s biggest microfinance institutions that offers loans through its app. Their standard loan scheme charges 29.5% per month for one-month loans (though this drops to 14.4% monthly for 12-month loans), which is still heavy for short-term borrowing.

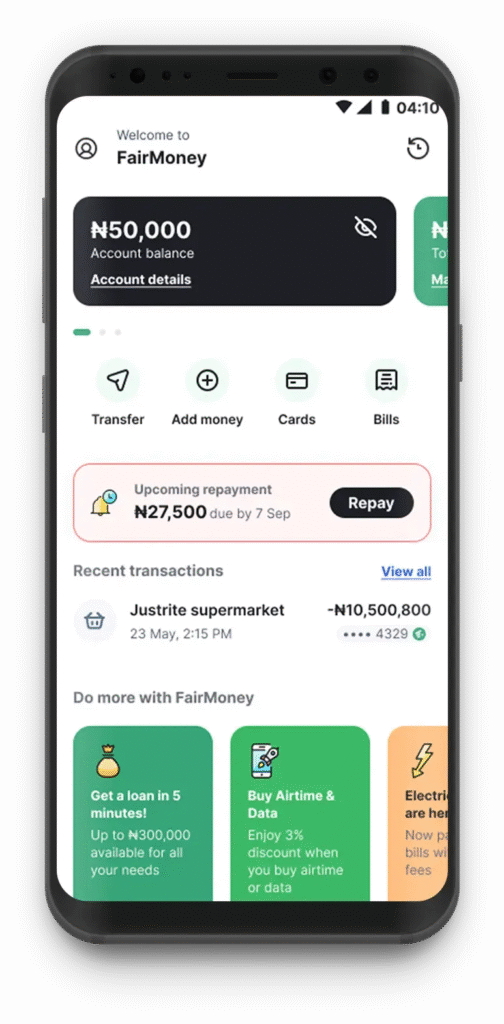

FlexiCredit, however, is a revolutionary departure. Think of it as a credit line or like having a ready-made loan wallet sitting in your account, waiting to be drawn whenever you need it. Instead of applying for a fresh loan each time, you activate your credit line once and can dip into it whenever emergencies strike.

The process is straightforward:

- Activate FlexiCredit in the FairMoney app within the 15-day offer window

- Withdraw from your credit line anytime you need funds

- Repay according to how many days you’ve actually used the money

That last part is the real breakthrough. Unlike standard loans, FlexiCredit charges daily interest only on the money you’ve withdrawn, for exactly the number of days you use it.

How It Works

Here’s how it works in practice:

Regular FairMoney loan

Borrow ₦50,000 and repay ₦64,750 after 30 days at 29.5% interest. Even if you repaid after just 2 days, you’d still owe the full ₦64,750.

FlexiCredit

You borrow ₦50,000 and repay only for the exact number of days you use it. The daily rate is 0.6%. So, borrowing ₦50,000 for 2 days means:

- ₦50,000 × 0.6% × 2 = ₦600 in interest

- Plus a 1% utilization fee (₦500)

- Total repayment: ₦51,100

- For 10 days, you repay ₦53,800

- For 30 days, instead of ₦64,750 with the regular Fairmoney loan, you pay ₦59,600.

That’s the difference between paying back ₦64,750 versus ₦51,100 on the same loan if you only needed it for two days. For salary earners who just need a soft landing before payday, or small business owners covering a short gap in cash flow, this is revolutionary.

Understanding the Minimum Amount Due

The minimum amount due is the least you must repay each billing cycle to avoid default.

The formula is: Minimum Due = % of utilized amount + Utilization fee + Interest accrued for utilized days

Meanwhile: Total Due = Utilized amount + Utilization fee + Interest accrued for utilized days

For instance, if you borrow ₦50,000 and hold it for 10 days at 0.6% daily interest, your total repayment is ₦53,500. But FairMoney may set a 15% minimum: ₦7,500 (principal) + ₦3,000 (interest) + ₦500 (fee) = ₦11,000. Paying this ₦11,000 keeps your FlexiCredit account active, though interest continues on the balance.

This means that you don’t have to clear the entire outstanding balance immediately. But you must pay at least the minimum amount (plus any overdue sums and accrued interest). If you don’t, you risk late fees, account blocking, or even loan restructuring.

Caveats To Keep In Mind

As attractive as FlexiCredit is, Nigerians need to read the fine print. Here are the key caveats:

Utilization fee

Every time you withdraw by transfer to your bank account, FairMoney charges 1% of the withdrawn amount. This doesn’t apply if you use the card option, but it matters if you take frequent small withdrawals.

Bank’s discretion

The credit limit and interest rate are entirely up to FairMoney. They can adjust, reduce, or cancel the facility at any time, sometimes without prior notice.

Strict recovery rights

If you default, FairMoney reserves the right to:

- Debit any of your linked bank accounts via your BVN

- Freeze or liquidate your FairLock savings

- Restructure overdue debt into a term loan after 60 days

Late repayment penalties

Interest keeps accruing daily until repayment is complete. Missing the minimum repayment due date attracts extra charges.

Offer not universal

FlexiCredit isn’t available to every FairMoney user. It’s extended at the bank’s discretion, likely based on creditworthiness and previous loan performance.

Monthly billing cycle

Your bill is generated on a fixed date every month, with total interest added to the amount due at that time. You must pay the minimum due within each monthly cycle to keep accessing the facility.

Why This Still Matters

Despite these caveats, the daily interest model makes FlexiCredit one of the fairest lending products in Nigeria right now. It aligns repayment costs with actual usage, rewarding those who borrow responsibly and repay quickly.

In a market where loan apps punish early repayment with rigid monthly charges, FlexiCredit does the opposite. It allows flexibility, transparency and—if used wisely—substantial savings. This could be especially useful for:

- Salary earners waiting for end-of-month pay

- Freelancers who know a client payment is due in a few days

- Small traders covering urgent short-term expenses

- Families who face sudden emergencies like medical bills or school fees

The Bigger Picture

Nigeria’s loan ecosystem is broken. Most apps exploit desperation, preying on people who only need a few days’ worth of credit. By charging full monthly interest regardless of tenure, they push borrowers deeper into financial distress.

FairMoney’s FlexiCredit is not perfect, its terms still favour the lender and it retains strong powers to recover debt. But in a field dominated by predatory practices, it offers a rare opportunity for Nigerians to borrow smarter, cheaper, and more responsibly.

Final Word

If you are the kind of borrower who uses credit sparingly, just to cover a few days ahead of salary or bridge a short-term expense, FlexiCredit might be the best-kept secret in Nigeria’s lending market.

Use it wisely, repay promptly and you’ll find it to be one of the lowest-interest loan options available today. But go in with your eyes open: read the terms carefully, be mindful of the fees and never borrow more than you can comfortably repay. In the conundrum of Nigerian loan apps, FlexiCredit offers a glimmer of fairness. And that, in today’s economy, is worth knowing about.

📌 Recommendation: If you already use FairMoney, check your app to see if you’ve been offered FlexiCredit. Activate it within the window if eligible. It may just be the most affordable loan you’ll ever take in Nigeria.