Globacom appeared on the scene two years behind MTN, Econet and MTel. It however, quickly distinguished itself through bold innovations, including billing calls per second and offering free SIM cards. These bold moves reshaped Nigeria’s telecom industry.

At its peak, Globacom was synonymous with football in Nigeria and Africa. It sponsored the Nigerian Premier League, the CAF African Player of the Year Award and the Nigerian Football Supporters Club. There was also its sophisticated and warm adverts that featured Nigeria’s most famous faces. All these now feel like distant memories. Two decades after disrupting the telecom industry, Glo now finds itself in steep decline with the best efforts to save it proving abortive.

Glo Got Nigerians Talking

In 2003, Globacom entered Nigeria’s still nascent telecom market and immediately positioned itself as a champion for Nigerian consumers. At the time, other providers were charging a flat rate of ₦50 per-minute. This held even if the 60 seconds were not exhausted. Nigerians felt ripped off and asked for per-second billing but the operators claimed this was impossible. Globacom proved them wrong and introduced per-second billing. This innovation alone forced its competitors to follow suit leading to a crash in the price of phone calls.

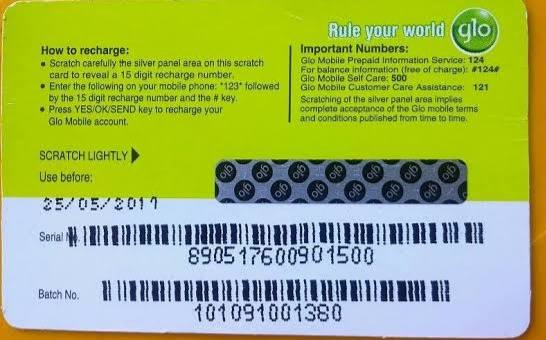

In October 2004, just a year after launching, Globacom struck again and started giving free SIM cards. This people-friendly move undercut rivals who were selling theirs for ₦2,000. This was more than most Nigerians could afford. This aggressive pricing strategy, backed by extensive marketing campaigns that featured Nigeria’s biggest celebrities as brand ambassadors, led to an explosion of Glo’s customer base.

Globacom’s early vision extended beyond voice services. Glo was the first to recognize that data, not voice, was the future of telecom. By 2004, while competitors were still focusing on voice calls, Globacom had already begun offering 2.5G internet service to 70,000 subscribers. In 2009, Glo showed that the Internet was the way by landing a 9,800km submarine cable in Lagos, becoming the Grandmasters of Data.

For its first eight years, Globacom was the story of a stellar indigenous success in a field dominated by foreign multinationals.

The Turning Point

Despite its promising start, Globacom’s innovative spirit began to wane as it entered the 2010s. It gradually lost momentum and became reactive rather than proactive in the rapidly evolving telecom industry. By the 2020s, Globacom’s decline was unmistakable as the company now developed a reputation for unreliable service and poor customer experience.

Operational issues mounted, culminating in a major cyberattack in August 2023 that compromised customer data. This incident went unreported for nearly a year. However, the most dramatic turn of events came in 2024, when an audit by the NCC revealed the company’s subscriber base.

The NCC had implemented a rule that set 90 days of inactivity as the baseline for counting active subscribers. This forced Globacom to shed a staggering 40 million subscribers from its reported numbers. This was a staggering 69% drop that left it with just 19.1 million active users and a meagre 13% market share. While competitors MTN and Airtel also had to adjust their numbers, they were relatively unscathed with massive 78 million and 53.7 million active subscribers respectively.

Adenuga: The Big Masquerade

According to Techcabal, insiders point to Globacom’s corporate governance structure as a primary factor in its decline. The company has operated under the tight control of its founder, billionaire Mike Adenuga, (nicknamed the Big Masquerade) whose leadership style has been characterized as highly centralized.

“It is run like a one-man business, and everything runs up to Mike Adenuga,” the source told Techcabal. “They can’t take any decision without his approval.”

Typically, Adenuga’s top-down decision-making structure created bottlenecks that hindered the company from innovating. In fact, the report clarified that several of Adenuga’s companies share employees which led to the blurring of the lines between businesses. The consequences of this management approach extended beyond day-to-day operations.

Multiple sources claim that Globacom missed an opportunity to partner with French telecom giant Orange due to issues with its leadership. Meanwhile, its vendors and partners have complained about persistent late payments by Glo that often extended to 180 days or more. In a particular instance, Glo owed MTN ₦3 billion in interest on interconnection fees for 15 years straight. It would later settle the debt for ₦2 billion without facing significant consequences.

There are multiple reports of Globacom getting into trouble for its debts. For instance, in 2021, it switch centre at Abuja was shut down by the Nigerian Civil Aviation Authority. In 2023, the NCC withdrew its regulatory services to Globacom after the company had failed to pay its debts.

Due to its dependence on Adenuga, Globacom was unable to independently raise capital. This has created a gap between it and industry leaders. For instance, unlike its competitors who outsource their tower infrastructure to specialized companies like IHS, Globacom insists on building and maintaining its over 8,700 towers, an approach that has proven costly and inefficient.

Failed Resurrection Attempts

In October 2024, under pressure from the NCC, Globacom named Ahmad Farroukh as its new CEO. This marked the first time since 2003 that someone outside Adenuga’s family would lead the company. Farroukh came with an impressive track record including former leadership positions at MTN Ghana, MTN Nigeria and Saudi Arabia’s Mobily.

Industry observers initially touted him as the saviour of Globacom. His experience in successful telecom operations seemed to position him well to reverse Globacom’s decline. The NCC itself appeared invested in seeing Globacom reform under new leadership, with one commission insider noting, “The new NCC EVC is focused on transforming Glo’s approach.”

The question, however, was: “Will he have the autonomy to drive meaningful change, or will Globacom’s founder, Dr. Mike Adenuga Jr.—often referred to as the “Big Masquerade”—limit his influence?“

Apparently, he didn’t and by January 2025, just one month into his tenure, Farroukh had stepped down. While Globacom issued no official statement, industry sources suggested that the centralized structure of the company and Adenuga’s continued influence had clashed with Farroukh’s management style. This rapid leadership turnover echoed previous failed attempts to bring in external talent, such as George Andah at Globacom Ghana, who also found their effectiveness limited by organizational constraints. This lead to the much-publicised failure of Globacom Ghana.

The Road Ahead

Globacom’s future is uncertain. Many industry observers are worried it will end up like 9Mobile (formerly Etisalat Nigeria), another telecom that began with promise before funding troubles and ownership changes left it struggling at the bottom of the market. In spite of that, Globacom retains valuable assets: its submarine cable still provides it a significant revenue stream and its national operator license allows for a broad range of service offerings. The question is whether these advantages can be leveraged effectively without fundamental changes to the company’s governance and culture.

Globacom is not beyond saving, but for it to regain its footing, it needs a significant injection of capital. “To be significant and deliver the right service, you probably need $1 billion in capital expenditure annually,” noted Bolaji Balogun, CEO of Chapel Denham, at a telecom event in August 2024. This should go along with a commitment to be more transparent and compliant, as well as a less rigid leadership style.

Its legacy as the indigenous disruptor that changed the game for Nigerian telecommunications hangs in the balance.