One of the first and most critical decisions you’ll make ahead of starting your business, is choosing a business structure. Your choice will impact everything from taxes and liability to fundraising and day-to-day operations. This guide explores the main business structures in the US, UK, and Canada and sets out 5 key considerations to help you make an informed decision.

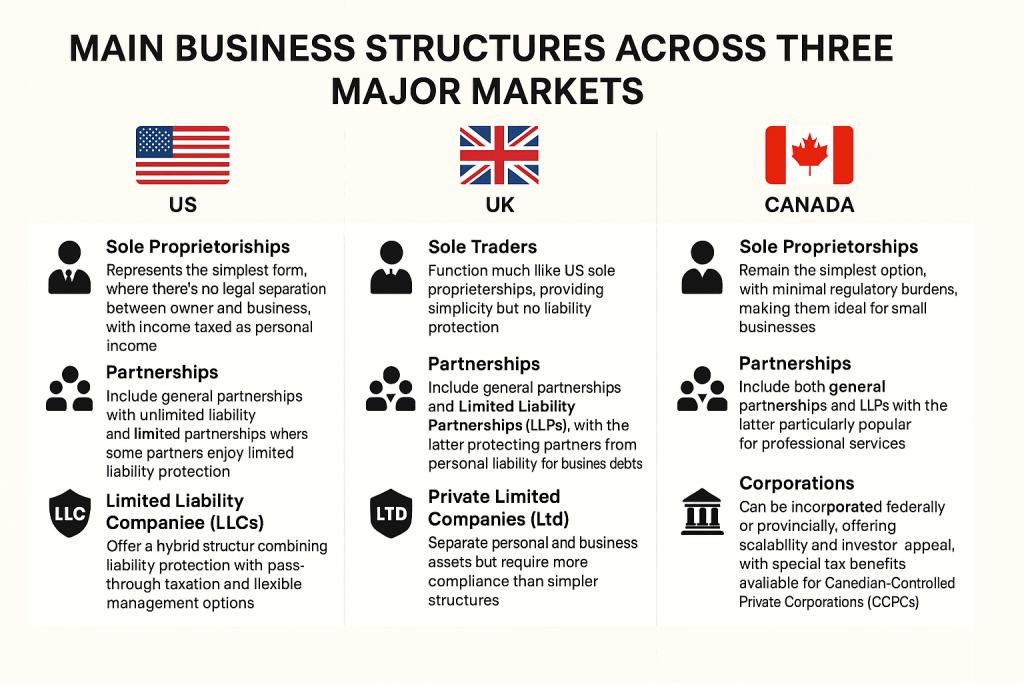

Main Business Structures Across Three Major Markets

United States

In the US, entrepreneurs can choose from several primary structures. They include:

Sole proprietorships represent the simplest form, where there’s no legal separation between owner and business, with income taxed as personal income.

Partnerships include general partnerships with unlimited liability and limited partnerships where some partners enjoy limited liability protection.

Limited Liability Companies (LLCs) offer a hybrid structure combining liability protection with pass-through taxation and flexible management options.

Corporations come in two main forms: C-Corps, ideal for raising capital but subject to double taxation, and S-Corps, which avoid double taxation but have ownership restrictions.

United Kingdom

The UK system offers similar yet distinct options.

Sole traders function much like US sole proprietorships, providing simplicity but no liability protection.

Partnerships include general partnerships and Limited Liability Partnerships (LLPs), with the latter protecting partners from personal liability for business debts.

Private limited companies (Ltd) separate personal and business assets but require more compliance than simpler structures.

Public limited companies (PLCs) are designed for large businesses seeking substantial investment and eventual public trading.

Canada

Canada’s business structure options closely mirror those of the UK and US.

Sole proprietorships remain the simplest option with minimal regulatory burdens, making them ideal for small businesses.

Partnerships include both general partnerships and LLPs, with the latter particularly popular for professional services.

Corporations can be incorporated federally or provincially, offering scalability and investor appeal, with special tax benefits available for Canadian-Controlled Private Corporations (CCPCs).

Key Considerations When Choosing A Business Structure

1. Control: How Much Autonomy Do You Want?

The level of control you wish to maintain over your business significantly influences your structural choice. Sole proprietorships and sole traders offer complete autonomy, allowing you to make all decisions independently without consulting others or following formal governance procedures. This makes them ideal for personal ventures like consulting or freelance work where quick decision-making is crucial.

Partnerships require shared control, with decisions potentially requiring consensus among partners. While this can slow decision-making, it also brings diverse perspectives and shared responsibility. The key is ensuring all partners align on major business directions and have clear agreements about decision-making authority.

Limited companies and corporations introduce more formal governance requirements, including directors, shareholder meetings, and sometimes board oversight. While this reduces individual control, it can enhance credibility with customers, suppliers, and investors who often prefer dealing with incorporated entities.

Recommendation: Choose a sole proprietorship or sole trader structure if you value complete autonomy and operate a low-risk business. Consider partnerships when you want to share responsibilities with trusted collaborators. Opt for incorporation when you need enhanced credibility or plan to bring in external investors who will require formal governance structures.

2. Personal Liability: How Much Risk Are You Willing to Shoulder?

Personal liability represents one of the most crucial considerations in choosing a business structure. Sole proprietors and general partners face unlimited personal liability, meaning their personal assets including homes, savings, investments, are at risk if the business faces bankruptcy or lawsuits. This exposure can be devastating for high-net-worth individuals or those in litigation-prone industries.

Limited liability structures, including LLCs, limited companies and corporations, create a legal separation between business and personal assets. This protection isn’t absolute since courts can sometimes “pierce the corporate veil” in cases of fraud or gross negligence. Regardless, it provides substantial security for business owners.

Professional service providers, contractors, manufacturers, and anyone dealing with significant contracts or potential liability should seriously consider limited liability protection. Even seemingly low-risk businesses can face unexpected lawsuits from customers, employees, or regulatory violations.

Recommendation: If your business involves significant liability risks, whether from professional services, physical products, employee management, or substantial contracts, choose a structure that offers limited liability protection. For truly low-risk ventures like freelance writing or simple consulting, sole proprietorship might suffice, but carefully evaluate your specific circumstances.

3. Seeking Investors: Do You Plan to Seek Out Investors?

Your fundraising intentions dramatically impact your optimal business structure. Sole proprietorships and general partnerships struggle to attract external investment because investors face unlimited liability exposure and have limited legal protections. These structures also lack the ability to issue equity stakes in traditional formats.

LLCs can raise capital but may need conversion to corporations for serious venture capital funding, as many institutional investors prefer corporate structures. They’re suitable for smaller investments from friends, family, or individual investors who understand the LLC structure.

Corporations excel at attracting investment, particularly C-Corps in the US, which can issue multiple classes of stock and accommodate unlimited investors. Venture capitalists and institutional investors strongly prefer corporate structures due to established legal frameworks and exit strategies through public offerings or acquisitions.

Recommendation: If you plan to bootstrap your business or rely on small loans, simpler structures work well. For businesses planning to seek significant investment, especially from professional investors or venture capital, incorporate as a corporation from the start to avoid costly conversions later.

4. Complexity: Would You Rather Not Deal with Complex Procedures?

Administrative burden varies dramatically across business structures. Sole proprietorships require minimal paperwork, often just registering a business name and obtaining necessary licenses. Tax filing remains simple, typically involving additional schedules on personal tax returns.

Partnerships add complexity through partnership agreements and potential state filings, but remain relatively straightforward. LLCs and limited companies introduce annual filings, separate tax returns, and ongoing compliance requirements, though these remain manageable for most small businesses.

Corporations face the highest administrative burden, requiring articles of incorporation, bylaws, board meetings, annual reports, separate tax filings, and various regulatory compliance measures. This complexity increases costs and time investment but provides maximum legal protection and credibility.

Recommendation: Start with the simplest structure that meets your liability and investment needs. You can often convert to more complex structures as your business grows and the additional protection justifies the increased administrative burden. Many successful businesses begin as sole proprietorships or LLCs and convert to corporations when seeking major investment.

5. Tax Considerations: What Is the Tax Burden Involved?

Tax implications vary significantly across structures and jurisdictions. Sole proprietorships and partnerships feature pass-through taxation, where business income is taxed at individual rates on personal returns. This avoids double taxation but can result in higher rates for successful businesses, as personal income tax rates often exceed corporate rates at higher income levels.

Corporations face potential double taxation, first at the corporate level, then on dividends to shareholders. However, they also offer tax planning opportunities, including income splitting between salary and dividends, business expense deductions and potentially lower corporate tax rates on retained earnings.

LLCs typically offer pass-through taxation while providing liability protection, but owners must pay self-employment taxes on business income. Some LLCs can elect corporate taxation if beneficial.

Recommendation: Consult with tax professionals to model different scenarios based on your expected income levels, growth plans, and personal tax situation. Tax laws vary significantly between jurisdictions and change frequently, making professional guidance essential for optimization.

Making Your Decision

Choosing a business structure requires balancing multiple competing factors. Consider your risk tolerance, growth ambitions, control preferences and administrative capacity. Remember that business structures aren’t permanent; you can always convert as your needs evolve, though this may involve costs and tax implications.

The right structure can save you money, protect your assets, and position your business for long-term success. So take time to thoroughly evaluate your options, consult with legal and tax professionals and choose the structure that best aligns with your business goals and personal circumstances.

Ready to turn your business dreams into reality?

Do you live in Canada, US or the UK and are looking to start and grow a business there? You don’t need a million-dollar idea or a network of insiders. You need a vision, a plan and the right guidance. Whether you’re an international student with a side hustle, a permanent resident looking to formalize a craft, or a newcomer dreaming of launching a food stall, we’ve got you covered. Our complete guide to building a business as an immigrant, covers the following for the US, UK and Canada:

- How to choose a business structure

- How to register your business

- How to open a business account

- Everything related to taxes, permits and licences

- How to fund your businesses and

- Other relevant information pertaining to international students, residents and non-residents.

Get it here today!